MILLIONS of Americans are heading to retirement, and not all of them have a personal advisor.

An influencer and certified retirement advisor recently shared his savings advice with The U.S. Sun.

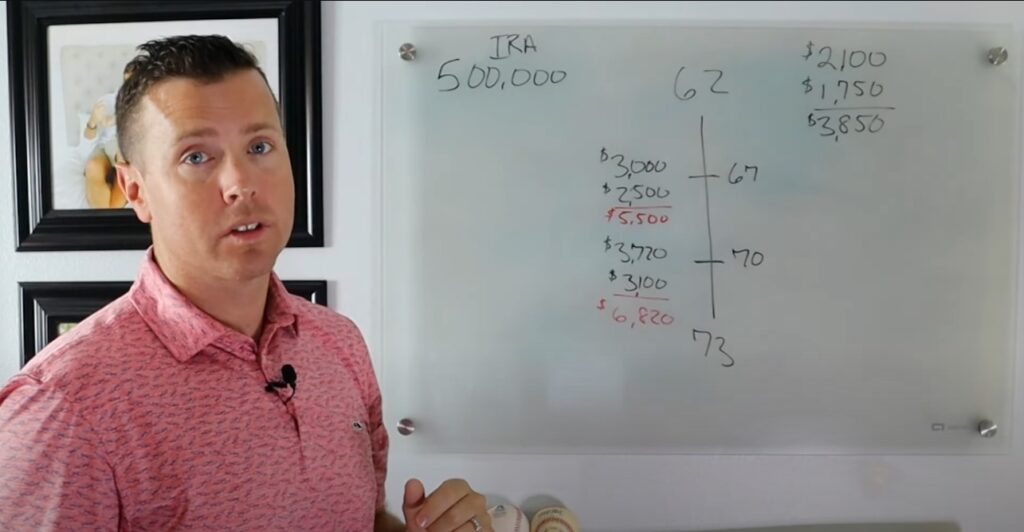

Drew Blackston, who shares financial advice in a series on YouTube, said he has advice for clients of any age, including beyond his channel.

While some of his clients have managed to save millions, many Americans struggle to save enough to retire comfortably.

“If you look at the averages, they’re not very good,” Blackston said.

The median American worker has just $87,000 saved for retirement, according to recent federal data.

Read More about Retirement

Blackston said he took to YouTube to share his knowledge with a broader audience.

“I want to be the people’s advisor,” he said.

HIS TIPS

Blackston said that small savings can add up.

“People don’t realize how small numbers can affect their accounts in a big way,” he said. “You can put $25 into a stock mutual fund, or you can put $25 into an ETF or something… but do something.”

“Start where you are and that is better than doing nothing,” he said.

He also said that while he can provide paths for people at any age, it’s best to start saving as early as possible.

Investing money means interest grows over time. That’s why small amounts can add up so quickly.

“God’s greatest gift outside of Jesus is compound interest,” he said. “And if you can compound your money at 22, 32, 42, it’s going to help.”

He also said that YouTube and social media are good places to find general advice, though he warned to exercise caution and listen to certified advisors like himself.

At any age, Blackston advises understanding where you are financially and starting from there.

RETIREMENT TROUBLE

While the average savings for workers is $87,000, other statistics are even bleaker.

A full quarter of American workers have nothing saved for retirement.

Social Security is meant to help people in this situation, though few can live comfortably on this payment alone.

Young people are in a particularly fragile economic situation when it comes to retirement prep.

The median savings for workers under 35 is just $18,800, though this group has time to start saving more.

Some are approaching their golden years in desperate situations, but financial advice online can help.

Blackston recently coached a 66-year-old divorced person approaching retirement with limited savings.

Another influencer, podcast host Dave Ramsey, has advised a number of people on how to get through tough times.

Ramsey recently gave direction to a 70-year-old who was still working with nothing saved up.

Blackston has shared several tips on how to retire early.