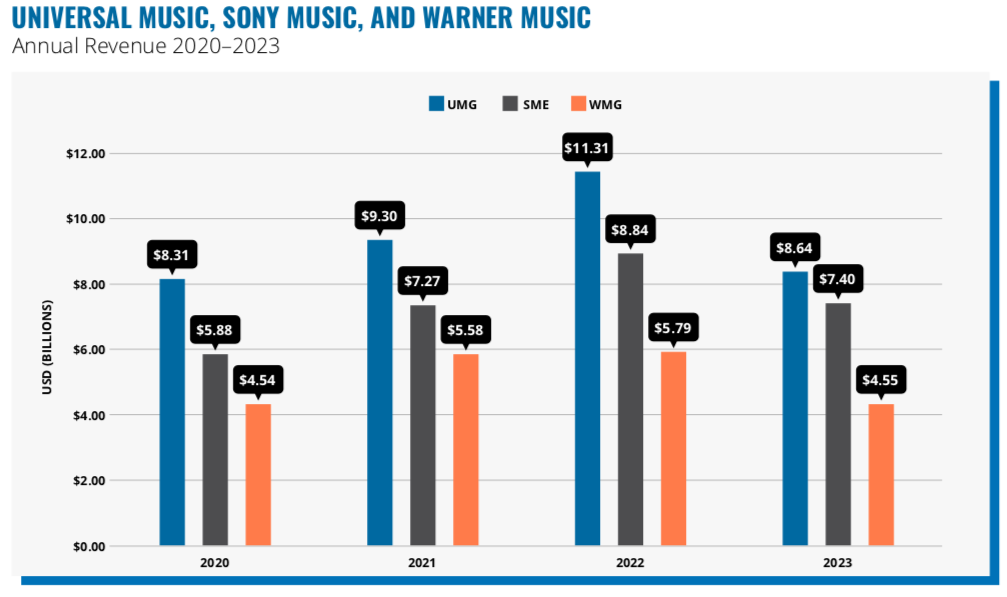

Comparison of major labels Universal Music, Sony Music, and Warner Music annual revenue by calendar year. Note: 2023 figures account only for calendar Q1, Q2, and Q3.

Comparison of major labels Universal Music, Sony Music, and Warner Music annual revenue by calendar year. Note: 2023 figures account only for calendar Q1, Q2, and Q3.

In our latest DMN Pro weekly analytical report, we take a closer look at investor sentiment surrounding Warner Music Group and the company’s retreaded vision under CEO Robert Kyncl. WMG is the perennial number three after Universal Music Group and Sony Music Entertainment, but what’s in store for 2024?

During his first 11 months as CEO of Warner Music Group (WMG), Robert Kyncl made a series of moves that he says will ultimately help the smallest of the Big Three labels to thrive. Despite these assurances and WMG’s improved Q3 financials, some investors remain uncertain about the company’s potential. So what’s next for this third-place behemoth?

“We’ve been working hard to build a WMG that will excel in the music industry of tomorrow,” Kyncl said during the company’s most recent earnings call. “Our work is already beginning to bear fruit, and I assure you that there is much more excitement to come.”

Shortly beforehand, however, certain investors had made clear that they weren’t necessarily on the same page.

As Digital Music News first reported, Wells Fargo initiated coverage on both Warner Music and Universal Music – with far different outlooks for each business. Analysts Omar Mejias and Steve Cahall set a $35 target price for Warner Music stock (NASDAQ: WMG) and indicated that they would “remain on the sidelines” until observing “sustained share recovery” and receiving “more clarity on tech investments.”

Regarding a stock-price rebound, Warner Music shares were worth $31.81 apiece when the market closed the Friday following earnings, reflecting a 10 percent decline since 2023’s beginning but an approximately 18 percent increase from late November of 2022.

But can Kyncl reverse that rather lackluster profile among investors?

In our latest weekly report, we take a closer look at Kyncl’s tech-based stewardship of Warner Music Group, and ask whether WMG can become an investor darling in a cooled-down financial climate.