Shared from Business of Fashion

The luxury fashion platform said in a filing to the Australian Stock Exchange that it has inked a deal to enter mainland China in partnership with e-commerce giant JD.com.

Cettire shares jumped 13.25 percent in early trading on Monday following the announcement by the e-tailer, which largely works with wholesalers in Europe to sell luxury goods at VAT-exempt prices.

This bounce back in its share price recovered much of the ground lost last week following the filing of Cettire’s financial report for the second-half of 2021. Though sales surged over the period, investors were spooked by the $8.3 million net loss recorded, down from a $2.3 million profit in the six months to the end of 2020.

The company said it will launch to mainland Chinese consumers during the second half of 2022, following its alliance with JD.com, which has over 550 million customers.

Even as Alibaba’s Tmall and its Luxury Pavilion has become destination du jour for global luxury brands looking to sell via third-party e-commerce platforms into the China market, JD.com has also been making inroads with its luxury offerings, notably building partnerships with traditionally e-commerce shy LVMH brands, including Louis Vuitton.

Mainland China is expected to be the world’s largest market for personal luxury goods by 2025, representing around 25 percent of the global market according to research from Bain & Co.

“China represents a vast market opportunity and it is core to our strategy to make our world class proposition available to additional markets,” Cettire founder and chief executive Dean Mintz said in the statement.

The statement also said that Cettire began supporting its planned China expansion with a series of technology hires in late 2021, and will use its local engineering capability to develop features specific to the mainland China market and Chinese speakers globally.

It’s unclear how exactly the partnership will be structured and whether Cettire will operate its own platform, or exclusively operate via JD.com’s marketplace in China.

BoF contacted both Cettire and JD.com for more information about the deal, but neither company was able provide further details prior to publication.

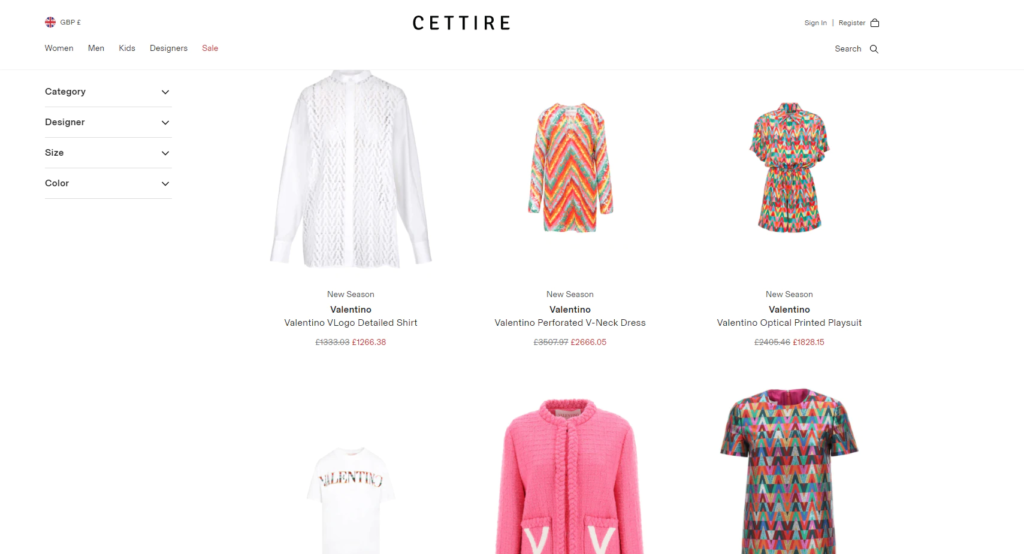

Cettire’s model largely relies on deals with third-party wholesalers in Europe, rather than direct relationships with brands (other than Italy’s Staff International, which it partnered with in November 2021) and holds no inventory of its own, with products ordered via its website sent directly from its suppliers. Cettire’s fulfilment is fully automated.

This model has seen the e-tailer, which listed on the Australian Stock Exchange in December 2020, referred to as a “grey market” player because the vast majority of the 1,700 brands on its platform, including Balenciaga, Gucci and Prada, have no say on the pricing of their products on its marketplace. Cettire also geoblocks French and Italian IP addresses, making it difficult for European fashion brands to trace where product is being sourced from.

Cettire is following in the footsteps of much larger rival Farfetch into the China market. In November 2020, Farfetch formed a joint venture in China with e-commerce giant (and fierce JD.com rival) Alibaba. As part of the deal, Alibaba and Swiss luxury group Richemont invested $300 million each in Farfetch, plus $250 million each in the Farfetch China joint venture.

Learn more:

The Rise and Stumble of a Grey Market Upstart

Cettire rode a pandemic luxury e-commerce boom to an IPO in December, but this week trading in its shares was halted after a precipitous fall.

Images and Article from Business of Fashion

#Luxury #ECommerce #Player #Cettire #Enter #China #Market #JDcom #Deal