Photo Credit: Coachella.com

The Coachella NFT collection that promised lifetime passes to the festival is now in limbo as FTX implodes.

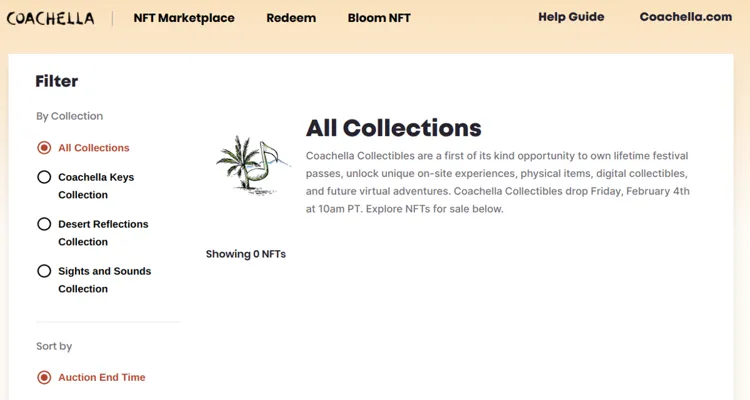

The ‘Coachella Collectibles’ were unveiled earlier this year and were advertised as “a first-of-its-kind opportunity to own lifetime festival passes, unlock unique on-site experiences, physical items, and digital collectibles.” Only the tokens that promised those benefits were backed by a cryptocurrency exchange that has now filed for bankruptcy protection.

What Happened to FTX?

The cryptocurrency exchange FTX appears to have lent out its customer deposits to sister company Alameda Research. Alameda Research is a crypto hedge fund that has invested broadly in the ecosystem with very little discretion. As Alameda Research collapsed, FTX became insolvent with a balance hole of $10 billion. FTX filed for bankruptcy-court protections on November 11.

The problem is that FTX was a major player in the NFT space with its venture capital arm, FTX Ventures. it invested in many NFT projects, including Yuga Labs’ Bored Ape Yacht Club. FTX was also the primary issuance for NFT collections for both Coachella and Tomorrowland. Notable sports brands caught up in the sta include the Golden State Warriors, the Washington Wizards and Capitals, Dolphin Entertainment, and Mercedes F1.

Members of the Coachella staff appear to be just as blindsided as everyone else by the exchange’s collapse. In a message posted to the festival’s Discord server, organizers say they’re not sure what to do. “Like many of you, we have been watching this news unfold online over the past few days and are shocked by the outcome,” a message on the Discord server reads.

“We do not currently have any lines of communication with the FTX team. We have assembled an internal team to come up with solutions based on the tools we have access to. Our priority is getting Coachella NFTS off of FTX, which appears to be disabled at the moment,” the statement continues.

The collapse of FTX could have far-reaching repercussions in the world of crypto. “FTX’s reputation holds significant weight in the perception of cryptocurrency among retail users and investors,” adds Gökçe Güven, Founder and CEO of Kalder. “The FTX collapse has impacted the average consumer who is less embedded in the crypto industry more than any other collapse since FTX was globally renowned and trusted. The NFT industry will see an increase in intimidation and skepticism among mainstream users in the short term.”