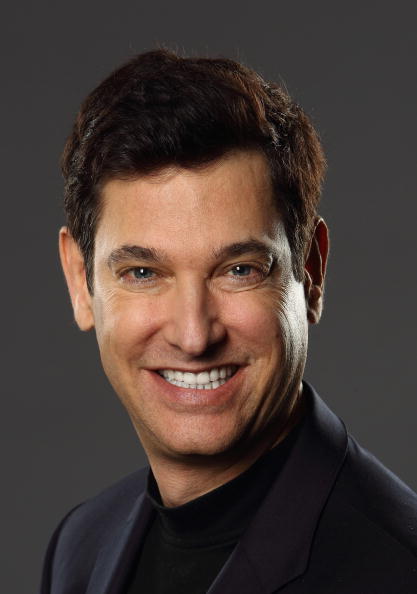

What Is Jim Breyer’s Net Worth?

Jim Breyer is an American venture capitalist who has a net worth of $2 billion. Jim Breyer is best known as the founder and CEO of Breyer Capital, a global diversified investment firm, as well as a partner at Accel Partners, a global venture and growth equity firm. Breyer made his career beginnings at Accel Partners in San Francisco, where he was mentored by Arthur Patterson and Jim Swartz. The young and talented Jim was named a partner by 1990, and five years later, he became a managing partner in the company. Ever since, Breyer has invested in more than 30 companies that have gone public or completed a merger. Some of his investments, including Facebook, earned over 100 times cost and others over 25 times cost. Today, Jim Breyer is still active in Accel investments as well as in the e-commerce site Etsy and Hollywood production studio Legendary Entertainment.

Early Life

Jim Breyer was born James W. Breyer in 1961, in New Haven, Connecticut. His parents, Eva and John, immigrated to the U.S. from Hungary. Eva was a Honeywell executive, and John worked at International Data Group as an executive and engineer. Jim attended Stanford University, earning a Bachelor of Science degree with Distinction in Interdisciplinary Studies in 1983. During his junior year, he studied in Florence, Italy, and as an alumnus, he got involved with the university’s Breyer Center for Overseas Studies there. After becoming interested in Silicon Valley’s technology industry, Breyer took part-time jobs at Apple Inc. and Hewlett-Packard as a college student. After graduation, he was hired by McKinsey & Company in New York to work as a management consultant. He enrolled at Harvard University, where he was a Baker Scholar and earned a Master of Business Administration. Jim graduated in the top 5% of his class at Harvard.

Andreas Rentz/Getty Images

Career

In 1987, Breyer began working for Accel Partners, a venture capital firm in San Francisco, and he was mentored by the firm’s founders, Jim Swartz and Arthur Patterson. Jim became a partner at Accel in 1990 and a managing partner in 1995. Accel Partners was Facebook’s second-biggest shareholder and owned an 11% stake when the social media company went public on the stock market. In 2005, when Facebook was a startup with just 10 employees, Breyer led Accel’s nearly $13 million deposit at a valuation of $98 million. In 2000, Jim launched a joint venture between Accel and the KKR private equity firm called Accel-KKR, and in 2004, he led Verizon’s management buyout of BBN Technologies. Breyer’s Series A investments include Etsy and Circle Internet Financial, and he has led investments in Spotify and Legendary Pictures. In 2006, he founded the global equity investor Breyer Capital, which “frames strategic investments anchored by the passion of founders, the insights of our network of world-class investors, and a conviction that artificial intelligence and machine learning will transform technology and investment opportunities globally.” Breyer Capital has invested in companies such as Marvel Entertainment and Brightcove. Jim joined the board of directors of the software company Wickr in 2014 and pledged $30 million in funding. In 2016, he joined the board of The Blackstone Group, an alternative investment firm.

In 2016, Breyer Capital began prioritizing investments in healthcare, artificial intelligence, and life sciences. Breyer Capital has invested in the biotech company Xaira as well as healthcare AI companies such as Paige AI, SandboxAQ, Atropos Health, Soley Therapeutics, and Iterative Scopes. In 2005, Jim helped set up a joint venture between Accel and IDG Capital Partners, which is based in China. He has served as a co-lead of the joint venture since its inception alongside IDG’s founder and CEO, Patrick Joseph McGovern. In 2016, the “Wall Street Journal” published an article about Breyer and IDG Capital Partners raising $1 billion for the IDG Capital Fund III, calling it “one of the largest venture-capital funds in China.” In 2017, it was announced that Breyer Capital would be suspending its investments in China for 18 months. According to “MarketScreener,” Jim “takes a cautious approach in China due to international political tensions.” Breyer has also been involved with China as a member of the Tsinghua University School of Economics and Management’s advisory board.

(Photo by ETIENNE LAURENT/AFP via Getty Images)

Personal Life

Jim’s first wife was artist Susan Zaroff, his college sweetheart, and they had three children, Daniel, Emily, and Theodore, before divorcing in 2004. His sons co-founded the cryptocurrency fund Breyer Labs and are partners at Breyer Capital. Jim wed Angela Chao, a philanthropist and Foremost Group CEO, in 2012, and they remained married until February 2024, when Angela drowned after accidentally backing her Tesla into a pond on the couple’s Texas ranch. Jim and Angela welcomed a son, James, three years before Chao died. Angela was the sister of former U.S. Secretary of Transportation Elaine Chao, who is married to former Senate Minority Leader Mitch McConnell. Breyer is a fan of the NBA team the Boston Celtics, and he became a minority owner of the team in 2001. He is interested in environmental sustainability and conservation and is a member of The Nature Conservancy, Environmental Defense Fund, and World Wildlife Fund.

Awards and Achievements

“Forbes” magazine ranked Breyer #1 on its “Midas List of Tech’s Top Investors in 2011, 2012, and 2013. In 2012, the Silicon Valley Forum honored Jim with its Visionary Award, and he was chosen for the “Vanity Fair” New Establishment Hall of Fame. In 2014, he received a “Venture Capital Journal” Lifetime Achievement Award as well as the American Academy of Achievement’s Golden Plate Award. In 2024, Breyer was presented with the University of Texas at Austin’s Presidential Citation Award.

All net worths are calculated using data drawn from public sources. When provided, we also incorporate private tips and feedback received from the celebrities or their representatives. While we work diligently to ensure that our numbers are as accurate as possible, unless otherwise indicated they are only estimates. We welcome all corrections and feedback using the button below.