Although Spotify reported a €231 million Q4 2022 operating loss earlier this week, its shares have rebounded by north of 20 percent since the performance analysis released.

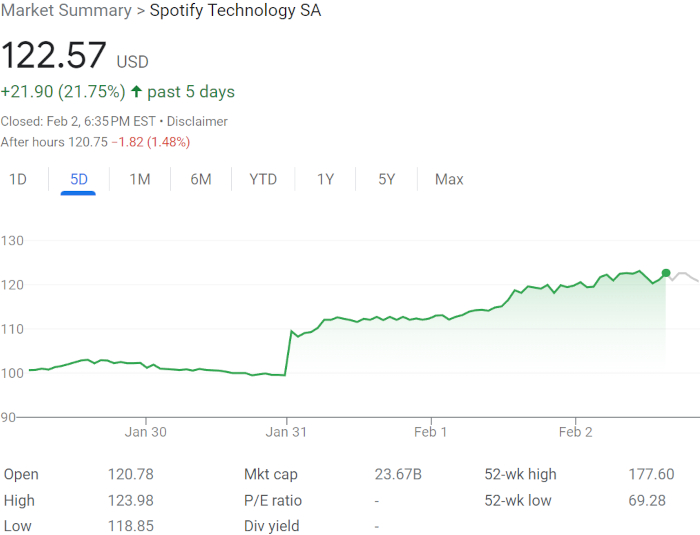

During today’s trading hours, the per-share value of Spotify stock (NYSE: SPOT) increased by about 3.71 percent from Wednesday’s close to finish at $122.57. The figure represents a roughly 22 percent improvement from SPOT’s day-end value on Monday, when shares were hovering around $100 apiece, and an almost 50 percent jump throughout the past month.

Moreover, the stock-price resurgence – which has enabled SPOT to surpass $120 for the first time since August of 2022 – kicked off after the Stockholm-headquartered company posted its fourth-quarter earnings on Tuesday morning.

In this Q4 2022 report, higher-ups identified a €231 million operating loss (up €3 million from the third quarter), as noted, and forecasted a further loss of €194 million for Q1 2023. But needless to say, given SPOT’s comeback, investors don’t appear particularly concerned with the figures despite the market’s current emphasis on efficiency and profitability.

Building upon the point, Spotify chalked up its Q4 loss to “personnel costs primarily due to headcount growth and higher advertising costs.” And last month, execs laid off six percent of the company’s team, or, factoring for the 10,151 full-time employees that Spotify had at 2022’s end, approximately 610 individuals.

Besides underscoring a clear-cut effort to reduce personnel costs and move closer to profitability, the layoffs are presumably indicative of plans to cease dropping substantial sums on rapid-fire acquisitions.

To be sure, Spotify across 2020, 2021, and 2022 took the opportunity to buy The Ringer, Megaphone, Podz, Sonantic, Podsights and Chartable, Findaway, Heardle, Kinzen, Whooshkaa, Locker Room, the rights to The Joe Rogan Experience, and more.

Additionally, notwithstanding continued economic turbulence, Spotify in Q4 posted its largest quarterly user growth to date, for a total of 489 million MAUs. Included within the figure are 205 million paid subscribers (up 10 million from Q3), and execs have forecasted 500 million MAUs (encompassing 207 million subscribers) for Q1 2023.

Worth highlighting in conclusion are the 2023 stock-price gains of other music industry companies, several of which have turned in double-digit growth of their own amid a reported rally throughout the broader market.

Specifically, Warner Music Group stock (NASDAQ: WMG) is up almost six percent since 2023’s beginning at $37.42 per share, having seen shares dip to around $22 each in October. Shares in Anghami (NASDAQ: ANGH), which reports previously suggested Spotify might buy, have rallied by an even 40 percent on the year, against a 17.4 percent boost for Reservoir Media stock (NASDAQ: RSVR).