Pebble Beach Golf Links is one of the most famous and exclusive golf courses in the world, but in the late 1990s, it was at risk of falling into corporate hands—again. The legendary course had already changed owners multiple times, from Hollywood studios to Japanese investors, with each sale raising the stakes higher. By 1999, the price tag had climbed to nearly $1 billion, and some of the biggest companies in the world were circling. But then, an unexpected group of buyers swooped in, led by none other than Clint Eastwood.

With a mix of Hollywood clout, sports power, and business savvy, Eastwood and his partners pulled off a stunning deal to keep Pebble Beach privately owned. Today, their investment has paid off in a big way—Pebble Beach is worth billions, and a single round of golf costs $625 per player, plus a required hotel stay that can push the total price well over $1,500.

Here’s how Eastwood and his team made it happen—and why it turned out to be a financial hole-in-one.

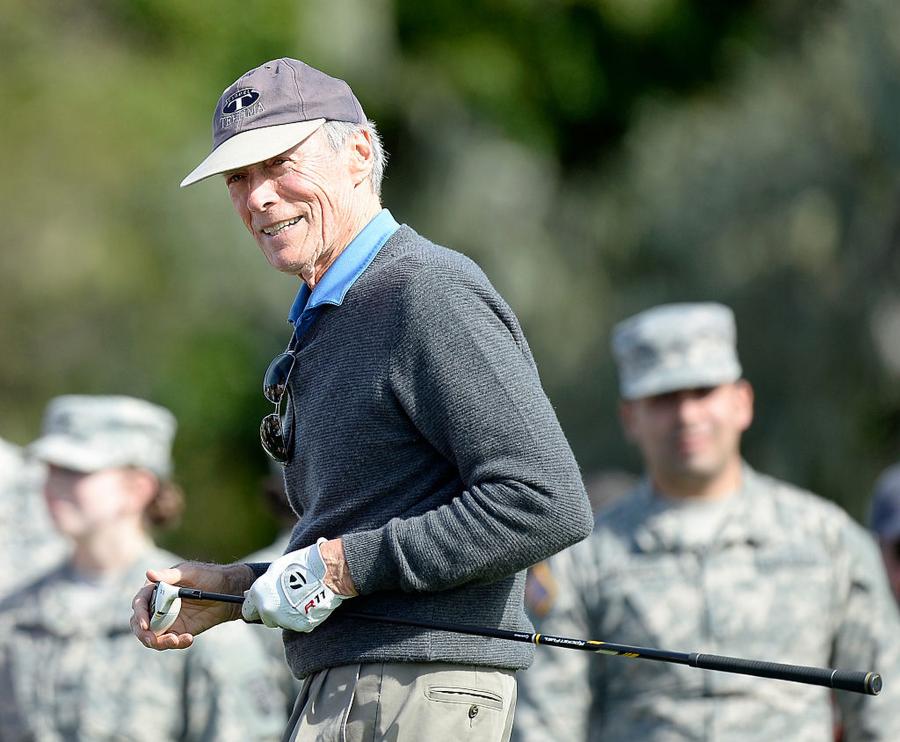

(Harry How/Getty Images)

History of Pebble Beach

Pebble Beach’s story stretches back over a century, filled with glamour and intrigue. The golf links officially opened in 1919 under the guidance of Samuel F.B. Morse, who purchased the surrounding Del Monte forest properties for about $1.3 million and nurtured the resort for 50 years. After Morse’s death in 1969, Pebble Beach began changing hands like a prized artifact. In 1979, 20th Century Fox – flush with cash from the success of Star Wars – bought Pebble Beach for approximately $81 million, folding the famed course into a Hollywood empire. By 1981, oil tycoon Marvin Davis acquired Fox (and with it, Pebble Beach), later selling the studio but keeping the golf resort he’d grown to love.

The lure of Pebble Beach only grew in the global boom of the 1980s. In 1990, Japanese businessman Minoru Isutani paid an astonishing $841 million for Pebble Beach, reflecting the era’s frenzied real estate values. But the bubble soon burst. Isutani ran into financial trouble and, just two years later, sold Pebble Beach to the Japanese consortium Taiheiyo Club for only $500 million – a $341 million loss on the deal. In barely a decade, Pebble Beach had been owned by a movie studio, a wildcatter, and international investors. By the late 1990s, this legendary course was again up for sale, and the stage was set for a new plot twist.

The Battle for Ownership

By 1999, word spread that Pebble Beach Golf Links was back on the market, igniting a bidding war as dramatic as a Hollywood thriller. Major corporations and resort developers lined up with eye-popping offers. Hospitality giants like Marriott and Starwood reportedly expressed interest, and even former owner Marvin Davis considered buying back the course. Rumors swirled of bids reaching and even exceeding $1 billion in the frenzy to claim America’s most famous golf property. It seemed inevitable that Pebble Beach would once again be scooped up by the highest bidder and treated as a trophy asset.

But one man feared a different kind of ending. Peter Ueberroth – the former Major League Baseball commissioner – had a deep worry about Pebble Beach’s fate if it fell into purely corporate hands:

“I was worried that a major American company would throw a great big number at it and then once they owned it, figure out an exit strategy five years later,” Ueberroth later told The Wall Street Journal, adding that Pebble Beach “isn’t a place that should be shuffled around.”

Determined to save the course from becoming a mere pawn in corporate dealmaking, Ueberroth set out to assemble an unlikely team of guardians to take Pebble Beach off the auction block for good.

That team came together like a real-life ensemble cast. Ueberroth recruited golf legend Arnold Palmer, former United Airlines CEO Richard “Dick” Ferris, and actor-director Clint Eastwood – each a powerhouse in his own realm. Their mission was not just to win Pebble Beach, but to protect it. Together, this group of friends and investors crafted a bid that was strategic rather than stratospheric: $820 million for the Pebble Beach Company, an offer actually lower than some of the competing bids.

On June 18, 1999, the agreement was sealed: the Pebble Beach Company (including the golf links and related resorts) were sold to the Eastwood-Palmer-Ueberroth group for $820 million. The purchase included not just the Pebble Beach Golf Links, but a whole constellation of assets that make up the Pebble Beach resort experience: three other championship golf courses and two luxury hotels:

- Spyglass Hill

- The Links at Spanish Bay

- Del Monte Golf Course

- The Lodge at Pebble Beach

- The Inn at Spanish Bay

The group even owns the famed 17-Mile Drive scenic road.

Amazingly, this wasn’t even the only golf course deal Clint Eastwood closed in 1999. That same year, he opened the private Tehàma Golf Club in the hills high above Carmel Valley. So Clint partially owns FOUR luxury golf courses in the Carmel area.

With this empire now under their care, Eastwood and his partners invested in upgrades – from course restorations to hotel renovations – carefully balancing improvements with preservation. They also negotiated agreements with environmental regulators to safeguard the surrounding forest and coastline, including a pledge to leave more than 600 acres of Del Monte Forest untouched by development.

Creative Financing

Finalizing the purchase of Pebble Beach Golf Links was as complex and carefully orchestrated as any movie deal – with a cast of characters to match. Financing for this colossal buyout came in part from Bank of America, which backed the investor group’s vision with significant loans. The remainder of the money was raised through a savvy financial strategy: the group invited a handful of ultra-wealthy friends to buy minority stakes in Pebble Beach at $2 million per share, essentially selling slices of this golf paradise to those who shared their passion. Those investors included the General Electric pension fund and other deep-pocketed individuals who were carefully chosen for their long-term commitment. In effect, Eastwood and his partners turned Pebble Beach into a private coalition of caretakers.

The Legacy Today

More than two decades have passed since Clint Eastwood and his partners took the reins at Pebble Beach, and the outcome has been nothing short of remarkable. Peter Ueberroth’s daughter, Heidi Ueberroth, now serves as co-chair of the Pebble Beach Company. Today, the Pebble Beach Company’s assets are worth at least $4 billion. The shares people bought in 1999 for $2 million fetch an estimated $8–9 million each today.

Pebble Beach’s success isn’t just financial—it has remained a world-class golf destination, carefully preserved under its current ownership. The course is still immaculately maintained, the resorts continue to thrive, and new projects, like Tiger Woods’ redesigned short course, honor its rich history while embracing modern appeal. Its prestige in golf remains unmatched, hosting multiple U.S. Open Championships, including the 100th edition in 2000, and securing future events through 2027.

Clint Eastwood, now in his 90s, remains an active co-owner and champion of Pebble Beach. He’s often seen at the resort, reinforcing the philosophy that guided the 1999 purchase: Pebble Beach is a treasure to be preserved, not flipped for profit.

Content shared from www.celebritynetworth.com.