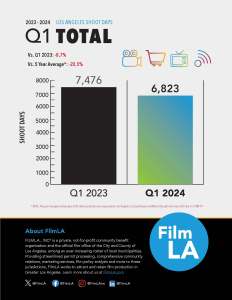

The dual Hollywood strikes are history, but production has been slow to return in Los Angeles, especially for television projects. The city and county’s film office said today that local on-location filming declined by 8.7% the first quarter, recording only 6,823 shoot days from January through March.

The quarterly report from FilmLA (read it here) cites a double-digit loss of television production as the main contributor to the decline. TV production was down 16.2%& year-over-year in Q1 — 2,402 shoot days vs. 2,868 in 2023). The current filming levels look much worse over a longer study period, as the television sector now its five-year category average by 32.8%

Reality TV production dropped 18.6% in the first quarter to 1,317 shoot days, while location-heavy TV drama production dropped 5.5% and less location-heavy TV comedy production plunged by 51.5%. TV pilots — nearly none of which were made in 2023 — saw a 842.9% rise in quarterly production but yielded just 66 shoot days.

Feature film production bucked the trend, though, rising slightly during Q1 with 634 shoot days to finish 6.6% ahead of the period in 2023.

The film office also blames runaway production, series cancellations and planned reductions in content spend as limiting industry output and work opportunities.

RELATED: Hollywood Contraction: How Writers Are Reacting To Ongoing Industrywide Cost-Cutting

“Since the first week of January, people have called FilmLA to say, ‘I am still looking for work. The phone isn’t ringing. Is the industry back?’” said FilmLA President Paul Audley. “Unfortunately, production is still slow, and things are not as they were.”

He added: “Many who weathered months without access to work and income had hoped filming would return quickly after the holidays. Production didn’t really stabilize until March, meeting our predictions while falling short of our hopes.”

RELATED: Hollywood Contraction Hits Entertainment Executive Jobs: “This Is A Full-Scale Depression”

The production of commercials for television and the web also fell in the first quarter, recording a 9.6% drop to 813 shoot days. Loss of production to other jurisdictions remains a concern, as local commercial production levels trailed their first quarter five-year average by nearly a third.

“Job seekers sometimes ask us how Shoot Days and days spent working on-location are connected to the creation of industry jobs,” FilmLA’s Audley added. “When we dug into the permit data and examined the self-reported number of cast and crew present and working on-location, we found additional evidence of the delayed return to work.”