In retrospect, the signs that trouble was brewing for Bitwise Industries had been piling up for months.

Lawsuits. Bounced paychecks. Missed property tax payments.

But for the last decade, the Fresno company had been selling a powerful dream to cities across the Central Valley and the country — places that had been left behind in the digital transformation of the economy. Bitwise offered workforce training to the underserved, software services, and co-working spaces to revitalize downtowns. City officials and community members rallied behind the business. Gov. Gavin Newsom even thanked the company for its services during the pandemic.

That dream was abruptly shattered when Bitwise furloughed all 900 of its employees on Memorial Day evening, as first reported by the Fresno Bee and Bakersfield Californian, with no explanations from any of its leaders ever since. Employees received notice Wednesday that their jobs had been permanently eliminated.

“We are facilitating here a fairly significant transition of our regional economy [and] we felt like they were going to serve a critical role,” said Kern County chief administrative officer Ryan Alsop. “They were a bright and shining star.”

Bitwise’s board of directors has since fired co-CEOs and co-founders Irma Olguin Jr. and Jake Soberal and hired Ollen Douglass, CEO of consulting firm Hanover Street Advisors, as interim president, the board said in a news release June 3. Meanwhile, former employees are pursuing legal action over missed paychecks and alleged labor violations.

“The Board of Directors was recently made aware of the company’s cash deficit by management and took immediate action as a result,” Douglass said in the release. “We are committed to determining the root cause and will continue to take swift action.”

Much remains to be untangled in the story of how the company imploded, but this much is clear: Bitwise was not a mere casualty of a slowing economy, as has been the case with so much of the tech industry that has suffered waves of layoffs. City officials and employees instead paint a picture of a decade-old beloved community institution of underdogs — one that seemingly disappeared overnight.

‘Insufficient funds’

In April, Olguin and Soberal sent an email out to employees announcing that payroll would be transitioning from direct deposit to paper checks.

“Your anxiety may be trying to tell you, ‘OMG the business is failing, we’re out of money.’ No. That’s not what this is about. We’re literally trying to make your lives simpler and remove uncertainty,” the email shared with The Times said.

And the preceding months of payroll issues? The co-CEOs wrote that those were due to everything from “bank failures to delivery problems to software glitches to literal natural disasters.”

The move to paper checks, they explained, was so the company could transition from small community banks to “larger, brand name banks where the size and complexity of our company can be better served.”

Multiple employees reported that their paychecks, which came from First Republic Bank, started bouncing in April, with one employee’s bank rejecting the check due to “insufficient funds” a week after the deposit was made.

After the switch to paper checks, 401(k) contributions also started to go missing.

Bitwise co-CEOs Jake Soberal and Irma Olguin Jr., right.

(Fresno Bee)

Again, Olguin and Soberal addressed employees in an email late May, saying the company had been “carefully tracking all 401K contributions manually since our switch from direct deposit,” and they were working on transferring contributions and company matches from their bank to John Hancock — their retirement account provider — in “partial deposits.”

Employees recalled Olguin and Soberal continually reassuring them that the company was doing fine and that many startups weren’t profitable. In one all-staff meeting, however, that left some of them unsettled, Soberal joked that he’d have to “fire like 15 of you guys to make payroll.”

“There were so many assurances of everything was fine,” said a former Bitwise director, who withheld her name because the company still owed her money. “If you questioned anything, you didn’t believe in the company and you kinda got iced out.”

That unease gave way to real panic around 8 p.m. Memorial Day, when Soberal sent an email informing workers of an “URGENT” all-staff call. By the end of that call, all 900 of Bitwise’s employees had lost their jobs in what the CEOs called a furlough.

Soberal told the Fresno Bee late May 29 that the furloughs were expected to be “a very temporary action” and that it was the result of “several critical [financial] transactions [that] either did not materialize or materialized unfavorably.”

“The events that we’re dealing with that led to furloughs of the team were very new and very unexpected,” Soberal told the Bee.

Some were initially hopeful they would eventually return to work, sending messages of encouragement to Soberal and Olguin on a companywide email thread. But Wednesday’s note to staff confirming the mass layoff settled any remaining doubts. Several employees have reported that their last two paychecks — covering three weeks of work — haven’t cleared. Those desperate to make ends meet have been unable to withdraw or borrow from their 401(k) accounts. Healthcare benefits have been terminated, with little information so far on how to apply for COBRA insurance.

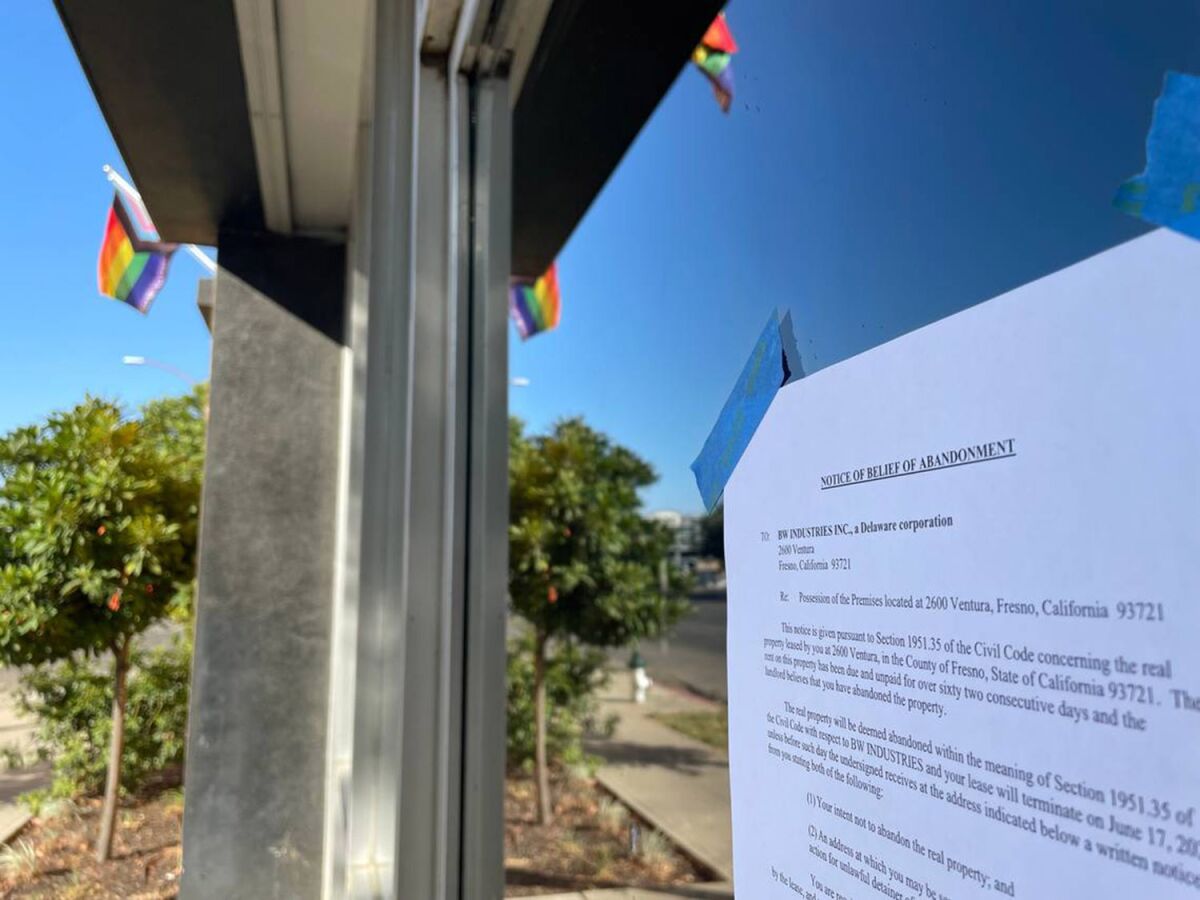

On June 2, the landlord for Bitwise’s three Fresno buildings was preparing to evict its errant tenant.

“The rent on this property has been due and unpaid for over sixty two consecutive days and the landlord believes you have abandoned the property,” read notices posted on the buildings, the Fresno Bee reported.

Olguin and Soberal did not respond to requests for comment.

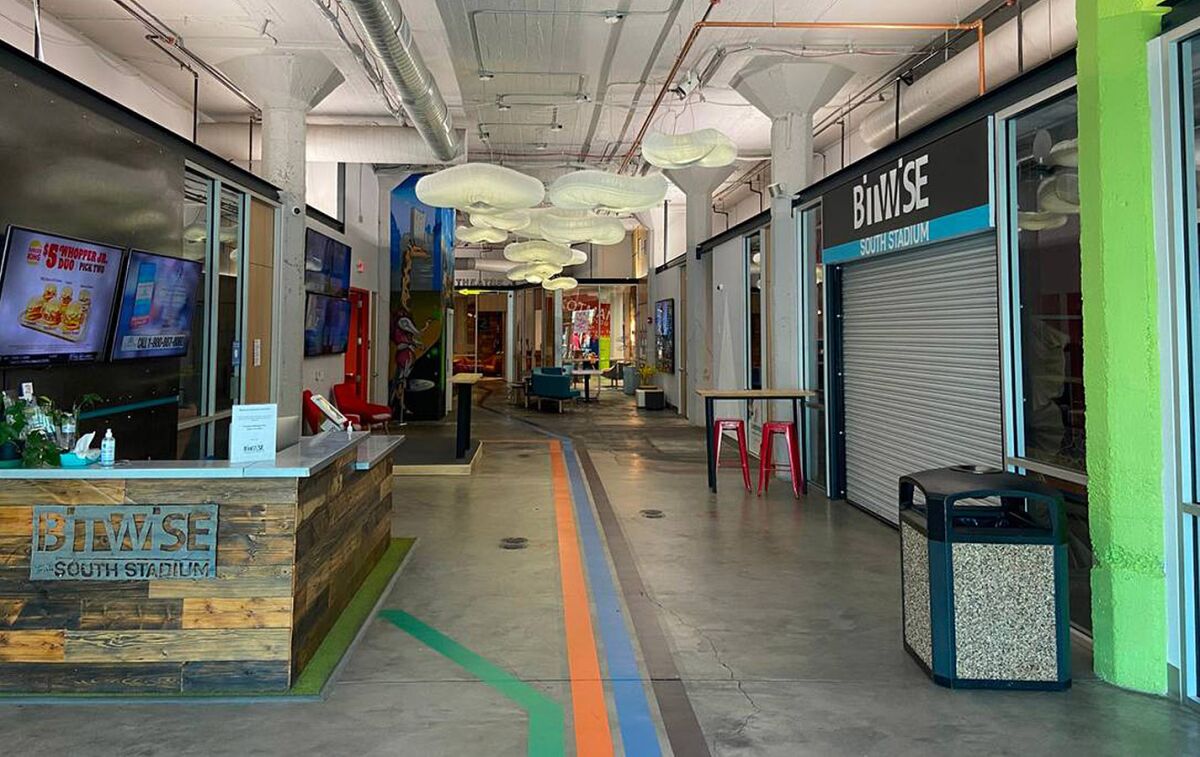

The empty main lobby of Bitwise South Stadium in downtown Fresno on May 31, two days after the tech services and real estate company announced it was furloughing its entire workforce.

(Marek Warszawski / Fresno Bee)

Christopher Ramos and his husband both worked for Bitwise, as well as his mother who was just hired in January after leaving her job of 10 years. On June 1, Ramos, who runs the Instagram account Vintage Fresno, explained the situation and asked for help.

“We wanted to work at Bitwise as a family until we all retired and believed in the work Bitwise was doing in the world,” Ramos wrote. “We can’t pay any of our bills and are left without answers.”

Since the company’s implosion, Fresno and Kern County officials have hosted resource and job fairs for former Bitwise employees with employers in need of tech-savvy hires.

Former employees also are pursuing a class-action lawsuit against Bitwise, asserting that the company violated the California Worker Adjustment and Retraining Notification Act, which requires adequate notice for mass layoffs or furloughs, as well as committed wage theft and numerous other labor code violations.

Olguin and Soberal have stated under oath that they had $80 million in their Central Valley Bank account as of March 9 of this year, the lawsuit said. The company had announced the previous month an $80-million funding round from investors including Kapor Center, Motley Fool Ventures, and Goldman Sachs, that was supposed to fuel their expansion to Chicago’s South Side.

“It begs the question, what do you do with $80 million in three months?” said Roger Bonakdar, an attorney with Bonakdar Law Firm in Fresno who’s representing the plaintiffs. “If they in fact had $80 million in March, they should have taken that money and earmarked it for the staff first to make sure they could have carried that payroll and benefit expense.”

Right after the furloughs, Soberal told investors “Bitwise is done” and admitted he was concerned about employee labor claims and liability, the lawsuit said.

The legal action names Olguin and Soberal as well as the members of the Bitwise board, which includes interim president Douglass.

“It is flatly impossible that the board did not know and did not contemplate the imminent and catastrophic consequences for all of these employees,” Bonakdar said.

Legal “notices of belief of abandonment” signs were posted on the exterior of the Bitwise 41, Bitwise South Stadium, and Bitwise Hive buildings on June 2.

(Melissa Montalvo / Fresno Bee)

Another class-action lawsuit was filed with lead plaintiffs including employees in New York and Maine in the Eastern District of California.

Douglass and the board did not respond to requests for comment. The only communication employees have received from him is a notice Tuesday to preserve company documents and records — indicating the company may be gearing up for a legal fight.

‘People really believed in Bitwise’

Despite receiving millions of dollars from investors and garnering enviable coverage in major news outlets, Bitwise’s operations — and how exactly it made revenue — may be puzzling to outside observers. That might be due to the sheer number of lines of business the company was juggling.

Bitwise began in 2013 as Geekwise Academy, a coding bootcamp based in Fresno, that initially targeted underserved populations such as veterans and the formerly incarcerated. Over the years, it acquired several buildings in Fresno, hosting local businesses and opening co-working spaces in California, Texas, and Ohio. There was also a software development arm, which employed many of its own former trainees. Bitwise raised a $27-million Series A round of funding in 2019 and Series B funding of $50 million in 2021.

The company also began to land hundreds of thousands of dollars in public funding through contracts with locales such as the city of Bakersfield and Kern County to operate a job training center as well as an accelerator for aspiring entrepreneurs.

During the pandemic, Bitwise launched the OnwardCA website to help match out-of-work Californians with jobs, an effort that received a shout-out from Newsom.

More recently in February, Fresno committed $1 million in American Rescue Plan Act funding to Bitwise to launch a Digital Empowerment Center for helping small businesses acquire digital tools and skills such as social media strategies, Salesforce software and search engine optimization.

Fresno Mayor Jerry Dyer said the city paid $500,000 and held back the other half until proof of performance. The city verified $120,000 worth of services provided two months ago but has no proof for the rest.

“I’m certain there are people today that will say, ‘I knew that they were snake oil salesmen,’” Dyer said. “But the truth is, I had not really heard that. I heard from a lot of folks, elected officials, business community, investors, people really believed in Bitwise.”

‘This truly was the best place I have ever worked’

Former employees paint a picture of a Utopian work environment where co-workers believed wholeheartedly in Bitwise’s mission — making the company’s abrupt downfall feel all the more like a betrayal.

One employee who joined in March 2021 said it was hard for her and her colleagues looking for jobs because they know they’ll never find another place like Bitwise.

“The most heartbreaking piece of it is this truly was the best place I have ever worked,” she said, asking that her name be withheld because the company still owed her money. “Every single person that worked at this community was a generally amazingly kind human being.”

Fresno lawyer Roger Bonakdar is working with more than a hundred California-based Bitwise Industries employees on a class-action lawsuit following the company’s decision to furlough its entire workforce last week.

(Craig Kohlruss / Fresno Bee)

Like many others, she was shocked by the news — especially since Bitwise had just announced its $80-million funding round in February.

Another employee, who also requested anonymity as she had not received her last few paychecks, cited Bitwise‘s success in creating a place of “diversity and inclusion” that made everyone feel welcome. The company is composed of 50% Black, brown or Native employees, 50% LGBTQ women, nonbinary, gender nonconforming, trans individuals, and 20% first-generation immigrant employees, according to its website.

“I can’t put into words… how betrayed I feel as a former employee,” she said. “It’s almost like the company disappeared overnight and they wiped everything.”

Untangling a complicated web

Bitwise faced plenty of other legal issues before recent events that indicated the company may have been in bad financial straits.

A Texas company sued Bitwise a day after the furloughs alleging the company had illegally borrowed almost $30 million using Bitwise buildings as collateral, and illegally listed several of those properties for sale, the Fresno Bee reported. Before that, Bitwise settled a suit alleging the company had not paid rent, utilities, taxes, and other expenses on several properties. In yet another suit, the company was accused of mishandling refund checks from the U.S. Internal Revenue Service that were owed to another entity — it cost Bitwise almost $6.4 million to settle.

Shortly after the furloughs, Dyer revealed the company had not been paying city business taxes since September 2021.

“We’re going to pursue that through legal means,” Dyer said of any money Bitwise owed to the city. “But I imagine we’ll be in a long line of people pursuing their losses as well, including investors that have lost tens of millions of dollars, not to mention the employees.”