Amid growth slowdowns in North America and Asia, besides double-digit expansions in other regions, global recorded music industry revenue increased by 4.8% in 2024. Photo Credit: IFPI

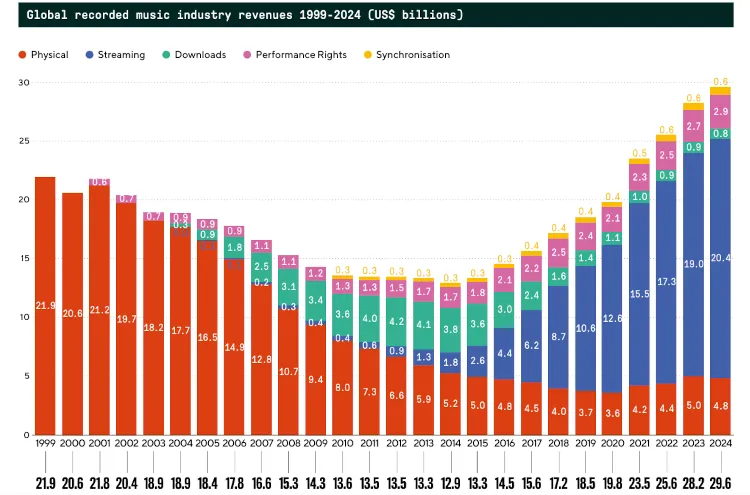

The global recorded music industry generated $29.6 billion in 2024, up 4.8% YoY, amid slowing stateside growth as well as double-digit expansions in Latin America, MENA, and more.

That’s according to the IFPI, which put out its 2025 Global Music Report (covering 2024’s revenue particulars) this morning. As many know, 2024 brought indications of a streaming-growth slowdown in the U.S., and the RIAA yesterday elaborated on the trend in its own annual report.

In other words, that the IFPI identified a modest 2.1% YoY recorded-revenue increase for the U.S. and Canada doesn’t exactly come as a surprise. Nor does the fact that streaming made up an even 69% of last year’s worldwide recorded revenue, up from a 67.3% share in 2023.

That comes out to a 7.3% across-the-board improvement in 2024 to $20.4 billion for streaming, which, all told, had 752 million worldwide “users of subscription accounts.” Amid price bumps, paid streaming revenue grew 9.5% YoY.

Meanwhile, behind 2024’s $29.6 billion in total revenue, 17.7% came from ad-supported streaming, representing a 1.2% YoY boost, the IFPI relayed.

As highlighted, on-demand listening’s 2024 gains (and those of the broader industry) are attributable in large part to double-digit spikes in streaming-heavy emerging markets.

Overall, each region save North America, Europe, Asia, and Oceania achieved double-digit growth last year, the IFPI indicated.

2024 Recorded Music Revenue Growth by Region

USA & Canada: 2.1% growth in 2024 (down from 7.4% in 2023)

Latin America: 22.5% growth in 2024 (up from 19.4%)

Europe: 8.3% growth in 2024 (down slightly from 8.9%)

Asia: 1.3% growth in 2024 (down from 14.9%)

MENA: 22.8% growth in 2024 (up from 14.4%)

Sub-Saharan Africa: 22.6% growth in 2024 (down from 24.7%) to $110 million

About 75% of the total came from South Africa.

Australasia: 6.4% growth in 2024 (down from 10.8%) to $629 million

Behind the figures, Mexico (15.6% YoY revenue growth) supplanted Australia to become the 10th-largest recorded market in the world. 9.6% YoY growth for China and continually strong physical sales in South Korea helped offset a slight revenue dip for Japan, which ranks only behind the States by industry size.

Shifting to the physical side, revenue decreased 3.1% YoY to $4.8 billion in 2024, when a CDs decline was partially offset by a 4.6% YoY expansion for vinyl, the IFPI indicated.

Rounding out the 2024 data, the narrowly defined sync category is said to have delivered $650 million (up 6.4% YoY). Less the $412.6 million in sync revenue attached to the U.S. for 2024, that comes out to just $237.4 million for all non-U.S. licenses.

Lastly, despite yet another double-digit decline, permanent downloads brought in $828.8 million in recorded revenue last year, when public performances contributed $2.9 billion (up 5.9% YoY), according to the report.

Content shared from www.digitalmusicnews.com.