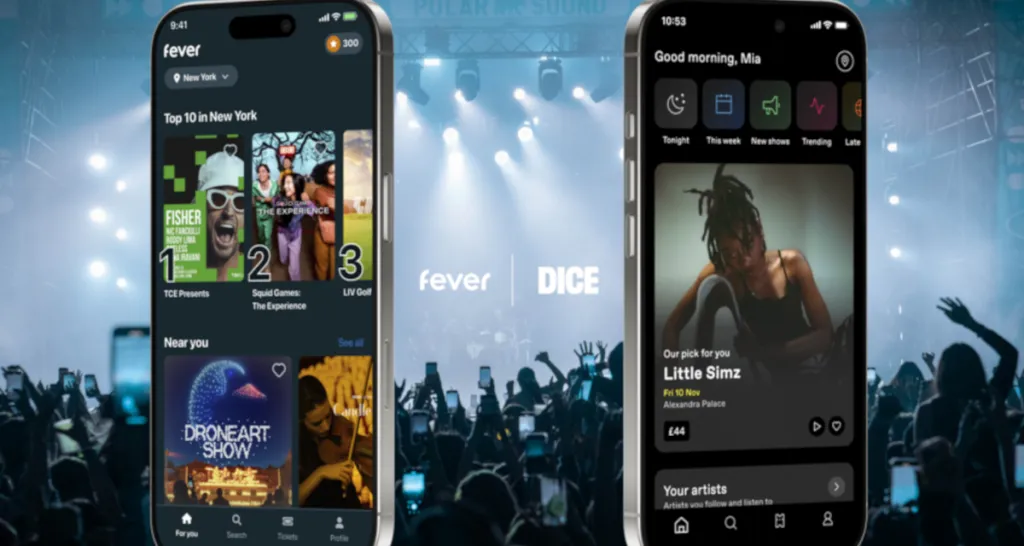

Live events platform Fever, which announced a $100 million raise yesterday, has officially acquired Dice. Photo Credit: Fever

Moments after scoring a $100 million raise, live events platform Fever has set its sights on the ticketing world with the acquisition of Dice.

New York City-headquartered Fever, which has secured at least $440 million from investors since 2022, unveiled the play today. As the purchaser sees things, the businesses’ “combined scale and capabilities” will power “a consumer-first, innovation-led platform” in the live arena.

Also as described by the Goldman-backed buyer, however, London-headquartered Dice’s existing artist, venue, and promoter clients can “keep using the platform exactly as they are” – while simultaneously tapping into Fever’s own audience. The latter is said to consist of some 300 million individuals situated across north of 40 countries.

“Together, we are strengthening our position as the leading global tech player for culture & live entertainment,” added Spain-born Fever co-founders Francisco Hein, Alexandre Pérez (formerly with Goldman and then KKR), and Ignacio Bachiller.

“At Fever,” the three proceeded in part, “we are firm believers that data and technology have the power to elevate the live music experience—making it more accessible, more personalised, and ultimately more impactful for fans, artists, and venues alike.”

Meanwhile, Dice founder and CEO Phil Hutcheon touted his platform’s current offerings and the perceived ability of today’s deal to fuel a buildout into new markets and crowd-based happenings.

(Regarding recent growth trends, Dice claims to have “more than doubled its ticket sales, surpassing 10 million monthly active fans,” during the past two years, the formal announcement notes.)

Not mentioned in these remarks or the wider release is the transaction’s price tag. Nevertheless, it’s been just shy of one year since reports pointed to Dice’s openness to a sale valuing it in the hundreds of millions of dollars range. (Unsurprisingly, Dice itself is far from light on investor support.)

It’s unclear whether the newly revealed purchase actually delivered a sum in that ballpark. But it’s safe to say there’s ample capital in the live and ticketing world, where StubHub is reportedly still eyeing a massive IPO.

Plus, Vivid Seats is said to be exploring a private equity sale at an eye-watering valuation, with the likes of TickPick ($250 million), Seat Unique ($20 million), XP ($6.2 million), and Celebratix ($1.2 million) having scored fresh investments during the last year or so.

In other words, despite a few indications of slowing live event sales, the space doesn’t lack enthusiasm or dollars. And though it probably doesn’t need saying, those with stakes in the sector have a clear-cut interest in encouraging direct expansions as well as revenue increases in adjacent areas.

Content shared from www.digitalmusicnews.com.