Ad-supported streaming plans are picking up steam on the video side — and raising questions about the music space heading into 2025. Photo Credit: Oscar Nord

Ad-supported VOD subscriptions are surging in the U.S. – and driving renewed discussions about the possibility of related pricing pivots for music streaming platforms in 2025.

VOD streaming’s continued ad-supported growth came to light in a new report from Antenna, a self-described “market data platform for the subscription economy.”

Diving directly into the relevant data, the Bertelsmann-backed firm indicated that as of Q3 2024, ad-supported video streaming tiers accounted for “43% of all subscriptions among those services that offer ad plans.”

As many know, said services now include everything from Peacock to Hulu and Disney+ to Netflix. According to the same breakdown, ad-supported subscription tiers at Netflix (44% of subs’ gross additions attributable to ad-supported), Max (39%), and Disney+ (62%) experienced sizable Q3 share spikes from the same period in 2023.

Meanwhile, VOD subs’ overall ad-supported total of 43% hiked 11% from Q3 2023, marking a material boost from Q3 2022’s 28%, per the analysis. At the intersection of those points, ad-supported VOD tiers’ share was largely flat between the top of 2022 (also 28%) and Q3 2023 (the above-disclosed 32%).

Furthermore, the percentage jumped from 39% to the noted 43% across Q2 and Q3 2024, the firm found.

Though it’s difficult to pin down the precise reasons behind the trend, rising subscription prices, pressure on consumers’ wallets, and the relatively new inability to share Netflix accounts (without paying an additional fee, that is) all come to mind.

In any event, from the perspective of the music space and otherwise, the trend is worth monitoring heading into 2025.

While there aren’t short-and-sweet answers to related questions, we aren’t without valuable insight here. At the top level, ad-supported listening generates significantly less revenue than its subscription counterpart, but is generally billed as a reliable means of adding users who may then subscribe down the line.

To be sure, Spotify’s ad-supported MAUs have increased substantially in recent years, numbering a cool 402 million as of Q3 2024’s conclusion. As we’ve covered when analyzing Spotify earnings for several quarters running, however, much of this growth is now attributable to users in emerging (and streaming-heavy) markets.

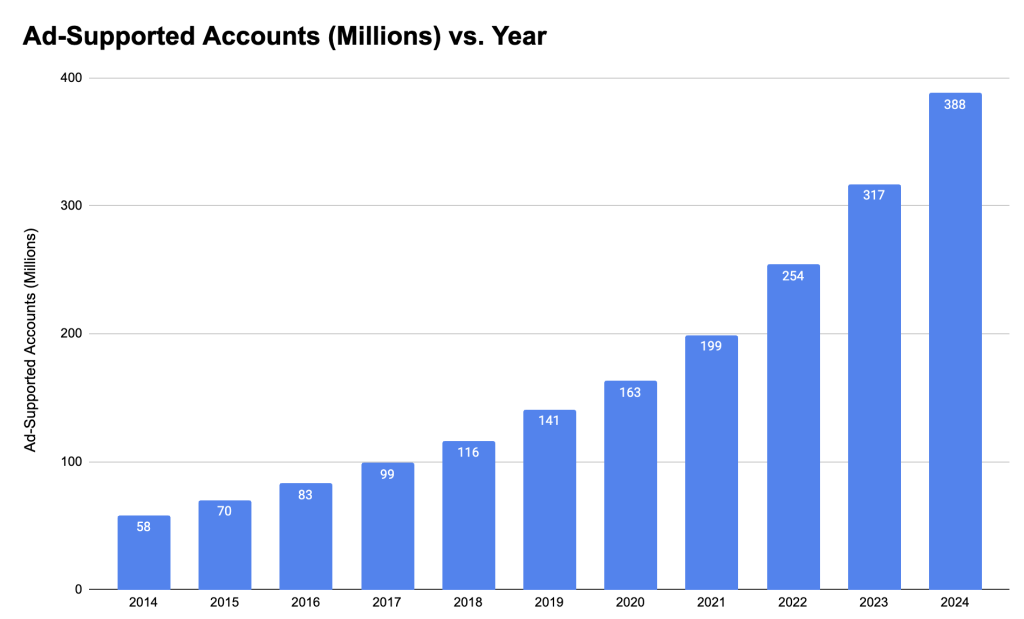

A breakdown of Spotify ad-supported accounts growth between 2014 and 2024. Photo Credit: Digital Music News

Specifically, 55% of Spotify’s total MAUs resided in regions besides Europe and North America as of this year’s third quarter. Taking that point a step further, it’s possible that Spotify’s freemium funnel has been, at least for the time being, tapped out in the States, where data is fueling fears of an outright Individual subscriber decline.

Then there’s the fact that Apple Music, which doesn’t have an ad-supported tier, reportedly boasts more Individual subs in the U.S. than its Spotify rival. Moreover, subscription-streaming growth is slowing at the majors, at least one of which has not so subtly called for charging for ad-supported listening in well-established markets.

In other words, it’ll be interesting to see where the points lead in the new year, which could be poised to deliver new streaming-compensation overhauls and more.