The Star Wars franchise is coming to shoot in California for the first time with The Mandalorian & Grogu movie, and the Golden State is paying out its weight in tax incentive gold to have the bounty hunter saga made within state lines.

To be specific, that is a total tonnage of $21,755,000 in conditional tax credits for the Jon Favreaudirected film. With a new Fantastic Four, Gladiator 2 and a new season of The Last of Us on his dance card, it is unclear right now if SAG Award winner Pedro Pascal will be resuming his role of Din Djarin and teaming back up with the charming Baby Yoda for the Mandalorian movie.

What is known is that $21,755,000 in tax credits is one of the biggest allocations in the California Film Commission run program’s history.

Put another way, Mandalorian & Grogu won’t be getting the $22.4 million that Transformers spinoff Bumblebee scored back in 2017, but it tops the more than $20.8 million that Captain Marvel was awarded seven years ago, and the $20.2 million that Quentin Tarantino’s supposed last film #10 received last September.

Disney+

Estimated to be hiring 500 crew members, 54 cast members, and 3500 background players for 92 filming days in California this year, The Mandalorian & Grogu is expected to generate a record-breaking $166,438,000 in qualified expenditures and below-the-line wages.

For a state looking at a bulging $73 billion deficit and an entertainment industry going through its painful Great Contraction, the Mandalorian movie is looking like the greatest job creator out of any movie awarded a tax incentive out of California’s program. For a more than $330 million per year program revitalized in 2014 as job creation centric and seeking to attract big budget movies back to the home of Hollywood, that’s a pretty big number – – even more so in the currently anemic state of the industry post-strikes.

The Disney/Lucasfilm production also knocks Disney/Marvel’s Captain Marvel off its perch as the previous top dog in qualified expenditures and below-the-line wages that mainlined into California’s economy. Partially filmed in Louisiana, the Brie Larson-led MCU picture generated $137 million into the California economy out of its production back in 2018.

Along with Amazon MGM’s recently acquired Chris Pratt-led Mercy, The Mandalorian movie and the 13 other films were awarded conditional tax incentives out of this most recent round of applications, The results of that round, which ran from January 22–29, are estimated by the CFC to eventually inject $408 million into California’s economy through qualified in-state expenditures.

“We are thrilled to be able to shoot in Los Angeles thanks to the tax credit,” said Mercy producer Charles Roven of today’s announcement, which will see the Timur Bekmambetov directed film get just under $4.4 million in incentives. “We get to work with terrific talent that lives here and utilize the wonderful locations. And almost everyone gets to go home to their own bed at the end of day!,” Oscar nominated Roven added.

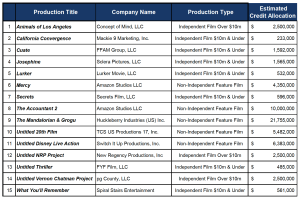

Take a look at the 15 films conditionally allocated about $61 million in tax credits below:

From the 35,000 feet perspective, the 15 films will hire a total of 2,252 crew members, 598 cast, and 16,800 background performers that will equal a combination of 579 filming days. In the belt tightening that Gov. Gavin Newsom and the legislature in Sacramento have had to do for this year’s state budget, the Tax Incentive program has been left untouched so far because of the jobs, expenditures and cash positive revenues it results in.

The next round of tax incentives allocation will be for the small screen, with applications being accepted February 26-28 for Recurring and Relocating Television Series, and from March 4-6 for New Television Series. The successful applicants for the $200 million in incentives available for that round will be announced on April 8. For the big screen, the next application period for the $80 million in tax incentives available will start in August.

As bounty hunter Din Djarin said in his first lines in the first episode of The Mandalorian TV series back in late 2019: “I can bring you in warm, or I can bring you in cold.” Yes, but in the competitive arena of lucrative tax credits and incentives around North America and the globe, everyone loves the warmth of big checks, don’t they?