A WOMAN has revealed that she made £70,000 in 90 days from her side hustle – and said she gets AI to do the work for her.

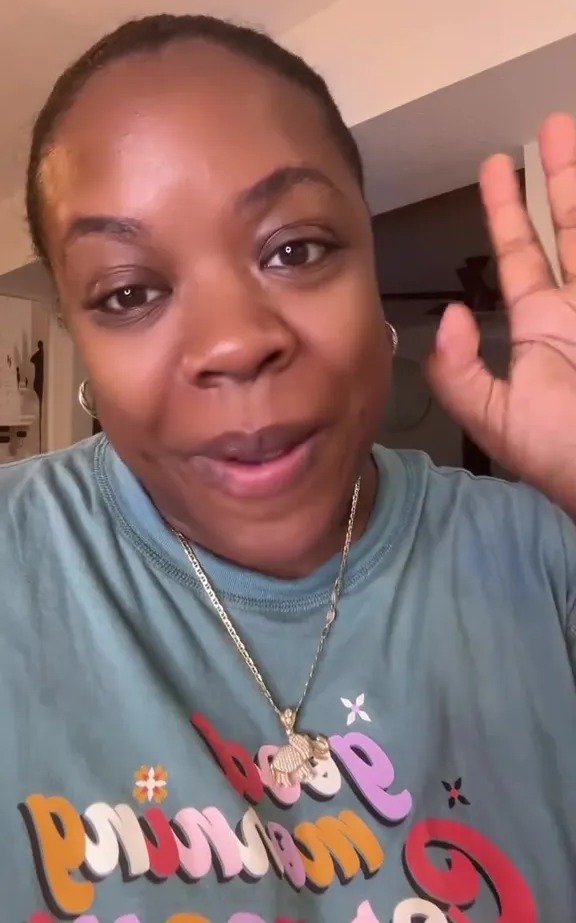

Bellah Roze took to social media to share details of her money making scheme.

In a TikTok video, she said that she has earned over a million pounds from selling digital products.

Digital products are intangible goods, such as music, ebooks, and online courses.

Bellah said that selling digital products is great because there’s a “94% profit margin”, as it costs you nothing to make.

She added that they are “easy to promote” and you never run out of inventory.

Bellah said that the first step to becoming a successful digital products seller is to go to Chat GPT and ask the AI to give you a list of digital products that directly resolve paint point for customers.

Then, take one of the things from the list and ask Chat GPT to create it for you.

For example, Bellah said you could ask the AI to create a cookbook on meals with low calories, to help those who are losing weight.

She said: “In less than 60 seconds, the AI will create the ebook for you”.

When the product has been created, head to Canva, and open up an ebook template.

Place the text onto the template and then ask Chat GPT to create a cover for the book.

When the product is finished, upload it to a sight like Amazon or Etsy, for a price of around £5.

You can then use social media, to market the product to those who would find it useful.

She said: “It takes less than an hour to make the product, and less than 60 seconds to make a video promoting it”.

Bellah’s video has likely left many impressed, as it has racked up over 1.1 million views on the video sharing platform.

TikTok users raced to the video’s comments section to share their thoughts.

Do I need to pay tax on my side hustle income?

MANY people feeling strapped for cash are boosting their bank balance with a side hustle.

The good news is, there are plenty of simple ways to earn some additional income – but you need to know the rules.

When you’re employed the company you work for takes the tax from your earnings and pays HMRC so you don’t have to.

But anyone earning extra cash, for example from selling things online or dog walking, may have to do it themselves.

Stephen Moor, head of employment at law firm Ashfords, said: “Caution should be taken if you’re earning an additional income, as this is likely to be taxable.

“The side hustle could be treated as taxable trading income, which can include providing services or selling products.”

You can make a gross income of up to £1,000 a year tax-free via the trading allowance, but over this and you’ll usually need to pay tax.

Stephen added: “You need to register for a self-assessment at HMRC to ensure you are paying the correct amount of tax.

“The applicable tax bands and the amount of tax you need to pay will depend on your income.”

If you fail to file a tax return you could end up with a surprise bill from HMRC later on asking you to pay the tax you owe – plus extra fees on top.

One person said: “I love all of this!

“All it really costs you is some time.”

Another person added: “It still blows my mind that Chat GPT is free!”

A third said: “Finished my ebook this morning.

“Let’s get this money.”

A fourth said: “Wow, thank you for this”.

Fabulous will pay for your exclusive stories. Just email: fabulousdigital@the-sun.co.uk and pop EXCLUSIVE in the subject line.