In the sixth edition of its Sound Stage study, FilmLA has highlighted growth in infrastructure in both the UK and Georgia, at the same time examining a widespread recent drop in studio occupancy, and a marked decrease in L.A.’s one-hour TV series production, specifically, in 2022.

Since the org’s last sound stage update in March of 2023, both the UK and Georgia added upwards of a million square feet of stage inventory to their existing supply, the study said. Now comparable to Los Angeles, the UK currently has around 6.6 million square feet of stage space, with plans to add dozens of new facilities. Georgia has over 4 million, with several significant projects in various planning and expansion phases. Read the full report at the link.

“Just like with trained crew, the availability of purpose-built sound stages is a factor that helps determine the attractiveness of any filming location,” stated FilmLA President Paul Audley. “Our study shows that many jurisdictions are expanding their stage infrastructure and competing harder for the business we also want to win for LA.”

According to FilmLA’s research participants, recent studio occupancy and utilization in Los Angeles and elsewhere have decreased, as was expected. Sound stage occupancy in the L.A. area peaked in 2016 and has since then been in the 90th percentile range. In anticipation of the double strike of 2023, one-hour TV series shooting in L.A. dipped from 235 to 200, from 2021-2022, reflecting an overall contraction in entertainment that’s still coming into focus.

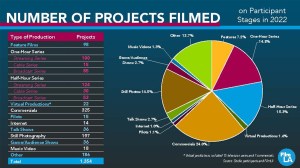

Overall, L.A. area stage operators reported an average annual occupancy of 90 percent in 2022, down -3 percent from the year prior. 1,354 projects were filmed in 35 facilities, generating a total of 10,356 stage shoot days. With the number of series episodes ordered per season declining across all segments of television, the number of shoot days that series generated declined by -36.4 percent between 2018 and 2022 from 10,582 to 6,901.

On a local level, FilmLA currently is tracking 18 new studio projects totaling roughly 3.5 million square feet of space in various stages of planning and development in Los Angeles.

The Sound Stage report is made possible by a data-sharing partnership with 17 participating studio operators — among them, the six major Hollywood studios, as well as the region’s largest independent operators, who together control 35 facilities and 83 percent of the estimated 6.5 million square feet of certified sound stage space available in Greater Los Angeles. Santa Clarita Studios is the latest studio to have its data included, after joining as a research program participant last year.

The full effect of the strikes’ disruption on L.A. area sound stage occupancy will be on display, FilmLA says, in reports still to come.

FilmLA