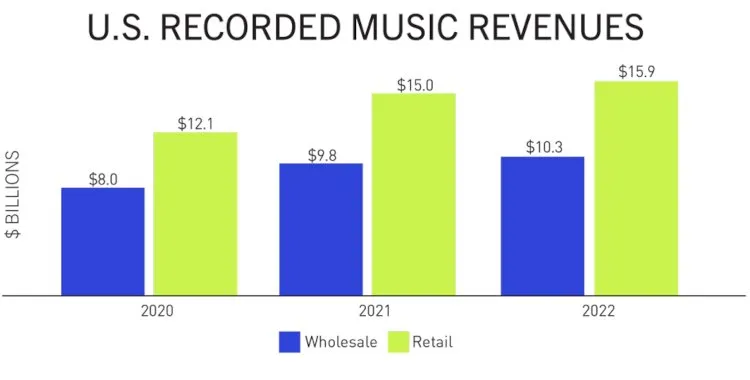

U.S. recorded music revenue approached $16 billion during 2022 as streaming subscriptions generated more than $10 billion for the first time, according to a new report. Photo Credit: RIAA

The value of the U.S. recorded music industry grew by 6.1% during 2022 to surpass $15.87 billion, according to a yearend report, as streaming subscriptions’ annual revenue cracked $10 billion for the first time and vinyl managed to outsell CDs.

These and other noteworthy data points came to light in a newly published 2022 analysis from the Recording Industry Association of America (RIAA). As usual, the above-mentioned revenue total reflects “estimated retail value.” The latter refers to “the value of shipments at recommended or estimated list price” as opposed to the actual (and potentially lower) prices for which vinyl and CDs were in reality sold.

Also worth highlighting at the outset is that the RIAA this time around implemented a “minor methodology modification” concerning the “calculation of total streaming revenues.” Said modification “was incorporated for 2022 data and applied to historical 2021 data for consistency,” the industry organization communicated.

Within the aforementioned $15.87 billion in music industry revenue – at wholesale value, revenue improved by 5% year over year (YoY) to a record $10.3 billion – streaming is said to have generated $13.27 billion (an increase of 7.3% YoY) and made up 84% of the total (a 1% YoY boost). The broad category encompasses streaming on dedicated platforms, social media, fitness apps, and much else.

Paid subscriptions surpassed $10 billion in annual revenue for the first time, as disclosed at the outset, consisting specifically of $9.18 billion for traditional premium accounts (up 7.2% YoY) and $1.06 billion for limited-tier paid accounts (up 18.3% YoY). Total on-demand subscriptions in the U.S. are said to have increased from an average of 84 million in 2021 to an average of 92 million, with multiuser plans having each been counted as one subscription.

Meanwhile, ad-supported streaming revenue rose by 5.5% from 2021 to exceed $1.80 billion, whereas SoundExchange distributions slipped by 3.3% YoY to $959.4 million and revenue associated with “other ad-supported streaming” jumped 28.5% YoY to $261.5 million.

Predictably, given streaming’s continued prevalence and expansion, revenue from permanent downloads once again fell, this time by 20.4% YoY to $494.7 million, according to the RIAA. “Synchronization income” for 2022 achieved a 24.8% YoY hike to reach $382.5 million under the entity’s classification guidelines.

Shifting to the physical side, vinyl is now responsible for about 71% of the category’s revenue, and in growing 17.2% YoY, the format managed to outsell CDs (41.3 million units to 33.4 million units) for the first time since 1987, per the RIAA. (The same was true of vinyl sales in the UK during 2022, according to a different report.)

Physical sales accounted for $1.73 billion in revenue at retail value (up 4% YoY), including $482.6 million from CDs (down 17.6% YoY), $1.22 billion from vinyl, $12.7 million from “other physical” including cassettes (down 9.1% YoY), and $11.3 million from “music video” (down 43.1% YoY).

Earlier this week, the British Phonographic Industry (BPI) released its own 2022 report, while ASCAP shed light upon its 2022 revenue and distributions yesterday.