An aerial shot of the highest-population city in California, which has the largest music industry GDP of any U.S. state. Photo Credit: Matthias Münning

Just how much money does the music industry contribute to the United States’ GDP? Courtesy of a new report, we have an answer to the question – on top of more intricate information about specific states’ own contributions.

That report comes from the RIAA, which tapped Secretariat’s Robert Stoner and Jéssica Dutra to create the top-level music industry GDP analysis as well as the state-level breakdown. The third such deep-dive published since 2018, the report focuses chiefly on 2017-versus-2020 comparisons and rather unsurprisingly draws from all manner of data sources.

Those sources include the Census Bureau, the Bureau of Economic Analysis, and the private sector, to name just a few. On the private-sector front, the RIAA pointed to supplemental contributions from indie labels and venues, PROs, music museums, and others yet.

Moving beyond the details and similarly involved methodology particulars, the overall U.S. music industry is said to have achieved a GDP of $211.8 billion in 2020 – 0.9% of the broader economy’s nearly $24 trillion GDP and a roughly 18% boost from 2017.

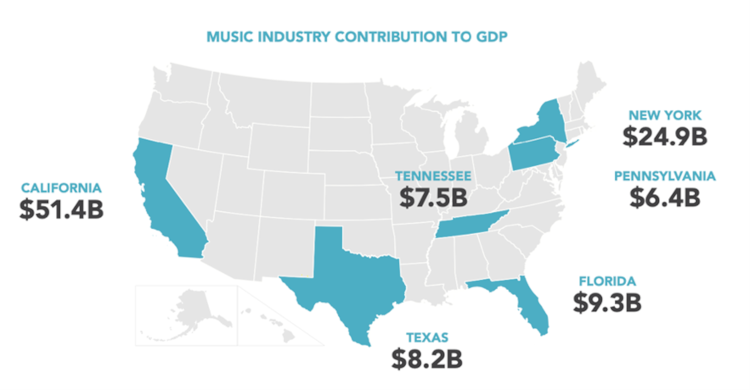

Predictably, California led the pack within the $211.8 billion sum, kicking in $51.4 billion in 2020 music industry GDP. New York followed with $24.9 billion, the report shows, as Florida placed third ($9.3 billion), Texas took the fourth spot ($8.2 billion), and Tennessee rounded out the top five ($7.5 billion).

The top-six states by total music industry GDP in 2020. Photo Credit: RIAA

Regarding music industry GDP’s percentage of each state’s total gross domestic product, Tennessee took the uppermost position with 1.7%, followed closely by California (1.5%) and then New York (1.3%). At the risk of diving too far into the details – the RIAA has put out a website featuring comprehensive state-by-state information – Florida’s positioning is interesting against the backdrop of continued Latin music growth.

Shifting to U.S. music industry employment specifics, the sector is said to have “supported,” both directly and indirectly, 2,539,280 jobs as of 2020 – a jump of 373,737 from 2017.

Spanning “a wide array of occupations,” those positions were heavily concentrated (nearly 43%) in the mentioned top-five states by industry GDP.

Closing with a look at the actual earnings of companies (and their employees) by NAICS code, manufacturers of musical instruments, audio and video equipment, and music software achieved the largest cumulative boost across 2017 and 2020, 43% to $8.26 billion, per the report.

(“Earnings” here refers to “wages, salaries and proprietors’ income,” besides employers’ health-insurance contributions, and extends to direct industry impact as well as “ripple” revenue.)

Next, in terms of cumulative percentage change between 2017 and 2020, agents, managers, promoters, and artists themselves enjoyed a 17.8% hike to almost $60 billion, according to the resource. The multifaceted music production and distribution category (encompassing publishers, studios, radio stations, and much more) saw a 13.2% earnings spike to $36.03 billion, followed by 10.7% for music schools ($116.12 million) and then 2.1% for retail establishments ($5.86 billion).