Photo Credit: RIAA

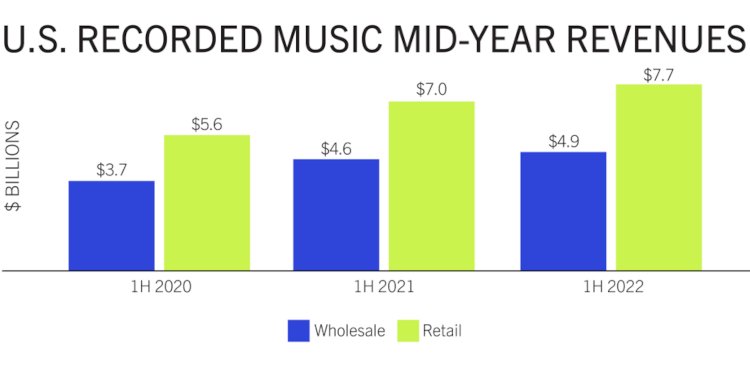

The U.S. recorded music industry generated $7.69 billion during 2022’s opening half, according to the Recording Industry Association of America (RIAA) – a figure that reflects comparatively modest year-over-year growth of about 9.07 percent.

RIAA officials unveiled the stateside music industry’s H1 2022 showing today, in a concise report that was emailed to Digital Music News. It bears clarifying at the outset that the trade organization calculated the above-noted total by factoring for “retail value,” or “the value of shipments at recommended or estimated list price.”

Needless to say, however, evidence and logic suggest that certain products ultimately sold for less than the “recommended or estimated list price” – meaning that the domestic recorded music industry’s H1 2022 revenue could in actuality be beneath the aforementioned retail value. (“Formats with no retail value equivalent” are “included at wholesale value,” the RIAA elaborated.)

In any event, streaming continued to account for the lion’s share of the total, the RIAA disclosed, at $6.47 billion throughout the six-month stretch.

The sum marks a 9.60 percent YoY improvement, but streaming’s portion of the overarching $7.69 billion in music industry income stayed flat against H1 2021 at approximately 84 percent. (Of course, the major labels’ respective earnings reports have reflected 2022’s broader digital slowdown.)

Within H1 2022’s streaming revenue, $5.03 billion derived from paid subscriptions, which encompass $525 million in “limited-tier” packages like those on Amazon Prime and “music licenses for digital fitness apps,” the document shows – for a YoY boost of roughly 10.11 percent, compared to 25.69 percent across H1 2020 and H1 2021.

Nevertheless, the six months ending on June 30th, 2022, delivered an average of 90 million U.S. subscribers for on-demand streaming services, per the resource, against 82 million or so in H1 2021.

(Each multi-user plan is classified as a single subscription, and for further reference, the figure hiked from 72.6 million to 82 million in H1 2021. Additionally, Spotify reported 188 million paid users for Q2 2022, with about 29 percent/55 million of these subscribers residing in North America.)

The remaining $1.5 billion that streaming’s said to have pulled down during H1 2022 resulted in part from ad-supported users (on platforms like Spotify and YouTube as well as social services such as TikTok and Facebook), at $871.5 million.

(As music featured on TikTok and related apps is rather directly synchronized with visual media, some have called for the associated income to be categorized as sync, U.S. royalties from which finished at just $178 million in H1 2022 under the RIAA’s classification.)

Rounding out the streaming side, the breakdown points to $566.4 million in “digital and customized radio service” revenue, down from $584.8 million in H1 2021. And predictably, permanent downloads continued their years-running descent, falling by double digits in the singles, albums, and ringtones categories alike for an overall decline of 19.1 percent to reach total income of $256.2 million.

Lastly, the U.S. recorded music market made $780.8 million (up 13.3 percent YoY) from physical releases during H1 2022, according to the analysis, as CDs slipped ($199.7 million total, down 2.2 percent YoY) but vinyl jumped by another 22.2 percent to crack $570.2 million. Vinyl now represents close to three-quarters of recorded music’s physical sales in the U.S., the RIAA said.