The California Film Commission has allocated more than $81 million to 24 film projects that have been selected for the latest round of the state’s Film & Television Tax Credit Program.

Together, the film commission expects the 24 projects to bring $662 million in total production spending to California, including an estimated $423 million in qualified expenditures – wages for below-the-line workers and payments to in-state vendors – and employ an estimated 3,173 crew members, 801 cast members and more than 29,000 background actors and stand-ins.

According to the film commission, the 24 film projects will also generate “significant” postproduction jobs and revenue for California visual effects artists, sound editors, sound mixers, musicians, and other industry workers and vendors.

“Our tax credit program continues to welcome a diverse range of projects, from big-budget films to small independent projects, and everything in between,” said Colleen Bell, executive director of the California Film Commission. “The program is an important tool for maintaining our competitiveness and curbing runaway production. We are working harder than ever to keep entertainment production here in California, where it belongs.”

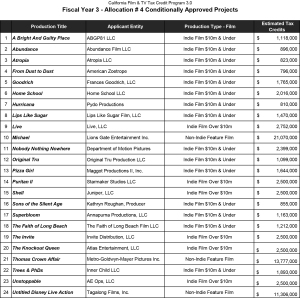

The three largest recipients of the state’s tax credit allocations are all big-budget studio projects: Lions Gate Entertainment’s Michael Jackson biopic Michael ($21,070,000); MGMs’ Thomas Crown Affair ($13,777,000) and an untitled Disney film from Tagalong Films ($11,306,000). None of the other 21 projects – all independent films – will receive more than $2,752,000.

According to the film commission, the three big-budget studio projects are expected to generate a combined $433 million in total spending and $265 million in qualified spending in the state, with Michael expected to generate more in-state spending than any other film in the tax credit program’s 14-year history.

The 21 independent films, meanwhile, are expected to generate a combined $230 million in total spending and $172 million in qualified spending in California.

The six independent projects with budgets over $10 million (Live, Puritan II, Shell, The Invite, The Knockout Queen and Unstoppable) are expected to generate a combined $128 million in total spending and $96 million in qualified spending.

Production for the 24 projects is set to occur over a combined 768 filming days in the state, with half of the projects planning to film outside the Los Angeles 30-Mile Studio Zone, for a combined 228 out-of-zone filming days.

First established in 2009 to help stem the flow of runaway production, the $100 million-a-year film and TV tax incentives program was expanded by the state legislature in 2014 to $330 million annually. Last year and this year, the program was increased to $420 million.