Elvis Presley, the King of Rock and Roll, earns more in death than most people ever will in life.

But since the rock legend’s death in 1977, that posthumous payload has seen its share of twists and turns, with everything from his music catalog to his likeness rights buffeted by the winds of capitalism.

The death on Thursday of Lisa Marie Presley, his only child, has thrown another wrinkle into that legacy, and it could mean further changes ahead for the estate — including Elvis’ iconic Memphis, Tenn., mansion, Graceland.

The property is in a trust that will now go to the benefit of Lisa Marie’s children, a Graceland spokesperson said. “Nothing will change with the operation or management,” the representative said in an email.

But Lisa Marie’s inheritance is complicated by a financial history as fraught as that of any rock star, and things could keep changing as it passes on to the next generation.

Presley is survived by her three daughters, actor Riley Keough and twins Harper and Finley Lockwood, from two different ex-husbands. Her stake in the estate, though diminished after past deals, is still sizable; in addition to Graceland, she retained ownership of her father’s costumes, cars, awards and other possessions, according to the mansion’s website.

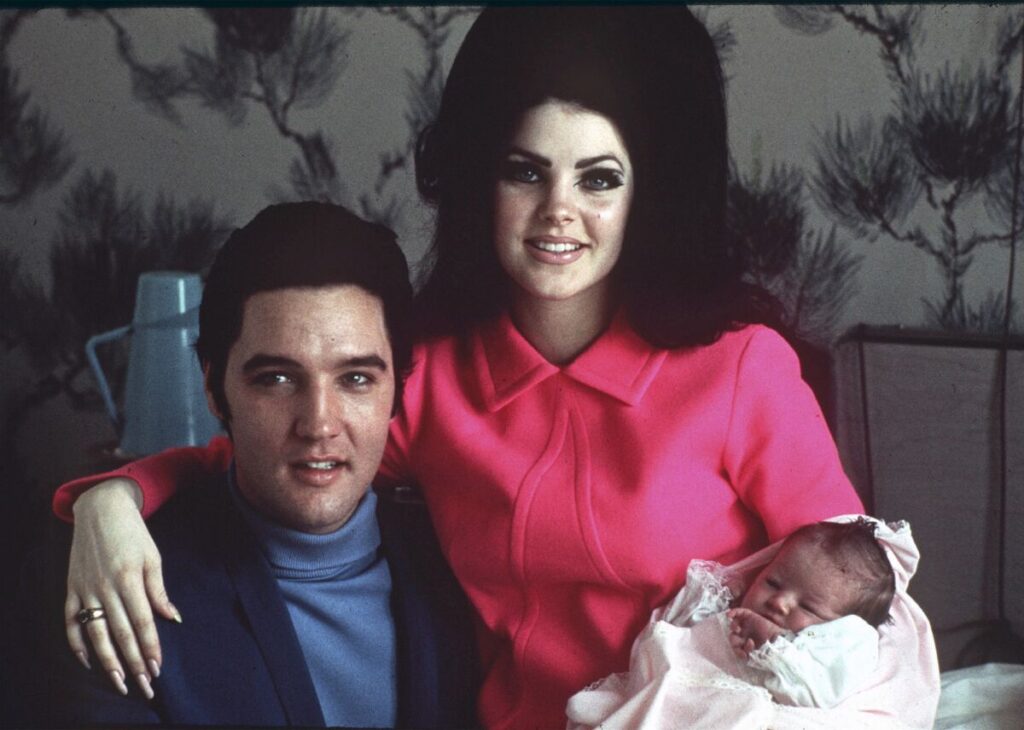

Elvis Presley poses with wife Priscilla and daughter Lisa Marie, in a room at Baptist hospital in Memphis, Tenn., on Feb. 5, 1968.

(Associated Press)

A fixture of music history, Graceland reports hosting 500,000 visitors a year across its 13-acre grounds and 17,552 square feet. Lisa Marie Presley will be laid to rest on the property.

Her father’s legacy is back in the mainstream (if it ever left) after a hit biopic directed by Baz Luhrmann and starring Austin Butler was released by Warner Bros. this summer. The film grossed $287 million at the global box office and is widely expected to be nominated for best picture at the Oscars.

With all the focus now on everything Elvis, things could get messy, according to legal experts who specialize in estates of high-net-worth individuals.

“There’s always complications anytime a single asset owner deceases and their assets are now going to go to multiple people because they may have different needs, different desires,” said Scott Rahn, founding partner at RMO LLP.

The issue that’s most likely to come up, Rahn added, is that Lisa Marie Presley’s daughters — now several generations removed from Elvis himself — may not want to keep their assets and could instead opt to cash out. They could even sell the storied mansion.

“Very often when you end up in that kind of situation, you do end up in a buyout situation … and then you get into valuation issues,” Rahn continued. Spurious claims on the estate, he said, are also likely to start coming out of the woodwork.

Presley, 54, helped oversee her late father’s estate before she died Thursday after suffering a cardiac arrest. A musician in her own right, Presley’s passing has prompted messages of heartbreak from many celebrities.

Born into the spotlight, Presley split her youth between Graceland and Los Angeles after her parents — Elvis and Priscilla Presley — divorced. According to the terms of her father’s will, Lisa Marie became the sole inheritor of Graceland and the rest of the “Hound Dog” singer’s estate, but her inheritance was held in a trust until she turned 25.

Lisa Marie Presley, second right, her daughter Riley Keough, left, and her twin daughters Finley Lockwood and Harper Lockwood, arrive at the 24th annual Elle Women in Hollywood Awards at the Four Seasons Hotel Beverly Hills on Monday, Oct. 16, 2017, in Los Angeles.

(Jordan Strauss / Invision via AP)

Although the rock star was a cash cow while alive, his lavish spending habits and shortsighted deal-making left the family in dire straits once he was gone. But with the founding of Elvis Presley Enterprises, Priscilla helped turn the mansion into a tourist attraction.

The property became a mecca for fans, yet also gained a reputation as tacky and crassly commercial. Nonetheless it proved a savvy business decision: In 2020, Forbes reported that the property typically takes in over $10 million a year.

(It’s a familiar story when it comes to the posthumous legacies of musical megastars. When Michael Jackson, Lisa Marie Presley’s onetime husband, died, he left behind half a billion dollars in debt — but by 2018, his portfolio had brought in four times that.)

When Lisa Marie Presley finally got access to her inheritance in 1993, she founded a trust in her father’s name to manage his estate. But in 2004, she agreed to sell off 85% of Elvis Presley Enterprises’ assets, including Elvis’ likeness rights, for around $100 million to music entrepreneur Robert F.X. Sillerman and his company CKX Inc. Lisa Marie Presley retained 15% ownership in Elvis Presley Enterprises.

Fortune reported at the time that the deal garnered CKX a 90-year lease on the mansion as well as the publishing rights to 650 Elvis songs, although the royalty rights to far fewer. Much of Elvis’ best-known music — the material recorded before 1973 — had already been sold to RCA by the rock star’s manager, former carnival barker Col. Tom Parker. Royalty rights for 24 Elvis movies were also included.

CKX Inc. subsequently sold the estate rights to the intellectual property firm Authentic Brands Group for $145 million. In 2020, one Presley executive told Rolling Stone that the Presley estate was worth around $400 or $500 million.

Through it all, Graceland — now a national historic landmark — stayed in Presley’s hands. If it gets sold off after her death, Elvis Presley Enterprises, run by managing partner Joel Weinshanker, would be a good bet for the buyer, said Los Angeles-based lawyer Tre Lovell of the Lovell Firm.

“They know the value of Elvis’s brand and would know best how to incorporate Graceland into their existing licensing business,” Lovell explained in an email.

Circumstances are further complicated by Presley’s personal financial issues. She claimed to be more than $16 million in the hole in 2018, and subsequently sued her longtime business manager over alleged financial mismanagement.

The manager, Barry Siegel, counter-sued, accusing Presley of wasting her inheritance and owing him money.

The New York Post reports that she owed over $1 million in taxes at the time of her passing. Benny Roshan, chair of Greenberg Glusker’s Trusts and Probate Litigation Group, raised the possibility that her successors will have to deal with creditors or litigation claims.

“One of the things that happens when administering somebody’s estate is that that’s the opportunity to present all valid creditors claims,” Roshan said, adding that creditors get priority over heirs. “There could be potential lawsuits if the creditors claim is rejected by the estate.”

“All of those issues are now going to come to the forefront,” he added.

Even if the family doesn’t need money to pay off Presley’s debts, there’s still a “strong likelihood” that Graceland gets sold off, said Ryan Sellers of the law firm Hales & Sellers.

“Depending on the personality and leverage of the kids, even if there is enough liquidity in the estate to keep Graceland and pay out creditors, will they have enough cash left over to support it?” Sellers asked in an email. At one point, taxes and maintenance expenses were costing Graceland over $500,000 a year, the mansion’s website claims.

The deciding factor could ultimately be how closely Elvis’ descendants want to keep control of his legacy — or at least, in Graceland, its physical manifestation.

“When you get to this generation, are they going to want to hold on to, maintain and honor those legacies?” asked Rahn. “Or is it something that as generations fade … those feelings fade with time?”