What was James Simons’ net worth?

James Simons was an American mathematician, hedge fund manager, and philanthropist who had a net worth of $32 billion at the time of his death. James Simons revolutionized stock trading in the 1980s through the use of computer-driven quantitative algorithms and artificial intelligence. These technologies made Simons one of the most successful investors of all time and one of 50 richest people in the world on the day of his death in May 2024 at the age of 86. SEC filings revealed that between 2006 and 2024 alone, James paid himself $12 billion worth of cash distributions. A former college math teacher, Simons was sometimes referred to as the richest teacher of all time.

Simons’ hedge fund, Renaissance Technologies, generated over $100 billion worth of returns between 1988 and 2018, primarily through its Medallion Fund. During that period the fund averaged an annual return rate of 66%. Medallion Fund was launched in 1988 and closed to outside investors in 1993.

If you invested $1,000 in the Medallion Fund at its inception in 1988, in 2024 you would have $42 million. If you invested the same $1,000 in the S&P 500, in 2024 you would have $40,000.

He was trustee for Brookhaven National Laboratory, the Institute for Advanced Study at Rockefeller University, Mathematical Research Institute in Berkeley, and was a member of the board at MIT Corporation.

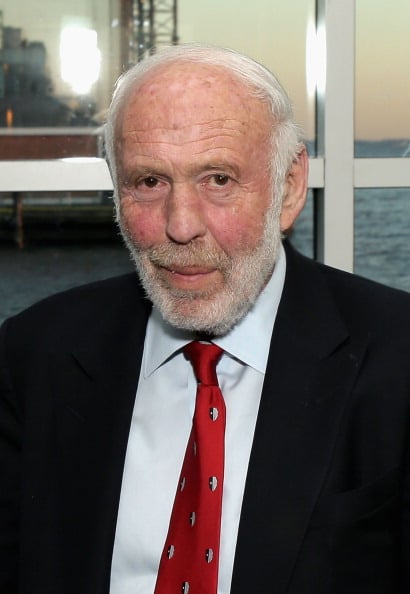

(Photo by Sylvain Gaboury/Patrick McMullan via Getty Images)

Early Life and Education

James Simons was born on April 25, 1938 in Cambridge, Massachusetts as the only child of Jewish parents Marcia and Matthew. He was raised in Brookline. For his higher education, Simons attended MIT, earning his bachelor’s degree in mathematics in 1958. He went on to obtain his PhD in mathematics from the University of California, Berkeley in 1961.

Scientific and Academic Career

In the scientific and academic communities, Simons was renowned for his studies on pattern recognition and his focus on the geometry and topology of manifolds. With fellow mathematician Shiing-Shen Chern, he developed the Chern-Simons forms of secondary characteristic classes. Elsewhere, Simons worked with the National Security Agency to break codes, and from 1964 to 1968 was on the research staff of the Communications Research Division of the Institute for Defense Analysis. Additionally, he taught mathematics at MIT, Harvard University, and Stony Brook University, and served as the chair of the math department at Stony Brook from 1968 to 1978. Due to his accomplishments, Simons received the American Mathematical Society’s Oswald Veblen Prize in Geometry in 1976.

Andrew Toth/Getty Images

Renaissance Technologies

In 1978, Simons founded the New York-based hedge fund Monemetrics, which was renamed Renaissance Technologies in 1982. The firm specializes in systematic trading using quantitative models, and employs specialists with backgrounds in mathematics, physics, and statistics, among other non-financial fields. In 1988, Renaissance established its flagship Medallion Fund, which contains only the personal money of the firm’s executives. Medallion became famous for having the best track record on Wall Street, earning over $100 billion in trading profits since its inception. Renaissance Technologies manages three other funds: the Institutional Equities Fund, the Institutional Diversified Alpha, and the Institutional Diversified Global Equity Fund. Simons ran Renaissance until his retirement in late 2009, although he remained a non-executive chairman until 2021. He remained invested in the firm’s funds until his passing in 2024.

Philanthropy

Simons was substantially involved in philanthropy through the Simons Foundation, which he co-founded with his wife Marilyn in 1994. The organization supports projects in the areas of health, education, and science. In 2003, the Simons Foundation established the Simons Foundation Autism Research Initiative. The following year, Simons founded the non-profit organization Math for America, which is funded by the Foundation. Later, in 2016, the Simons Foundation established the Flatiron Institute to house five groups of computational scientists.

Among its many other activities, the Simons Foundation is the largest benefactor of Stony Brook University, which is Marilyn’s alma mater, and a major benefactor of MIT and the University of California, Berkeley, James Simons’s alma maters. At Berkeley, the Foundation pledged $60 million in 2012 to establish the Simons Institute for the Theory of Computing. In 2023, the Foundation donated $500 million to Stony Brook, the second-largest donation to a public university in United States history.

Cindy Ord/Getty Images for World Science Festival

Personal Life and Death

In 1959, Simons married computer scientist Barbara Bluestein. The couple had two sons named Paul and Nat and a daughter named Liz before divorcing in 1974. In 1996, Paul was struck and killed by a car while riding a bicycle on Long Island; in his memory, Simons established the Avalon Nature Preserve in Stony Brook, New York. Meanwhile, Nat went on to become a billionaire hedge fund manager like his father, and Liz became an educator and philanthropist.

With his second wife, Marilyn Hawrys, Simons had a son named Nick who worked in Nepal. In 2003, Nick drowned on a trip in Bali, Indonesia. Simons and his wife subsequently made large donations to Nepalese healthcare through the Nick Simons Institute.

Simons was known for staying out of the public eye and seldom giving interviews. He also did not wear socks. On May 10, 2024, Simons passed away in New York City at the age of 86.

All net worths are calculated using data drawn from public sources. When provided, we also incorporate private tips and feedback received from the celebrities or their representatives. While we work diligently to ensure that our numbers are as accurate as possible, unless otherwise indicated they are only estimates. We welcome all corrections and feedback using the button below.