A new report from The Wall Street Journal says NFT sales are collapsing. Is that really true?

The report claims that NFT sales fell to a daily average of about 19,000 this week. That’s reportedly a 92% decline from September, but the data cited comes from the website NonFungible. However, on-chain data from blockchain analytics firm Dune suggests otherwise.

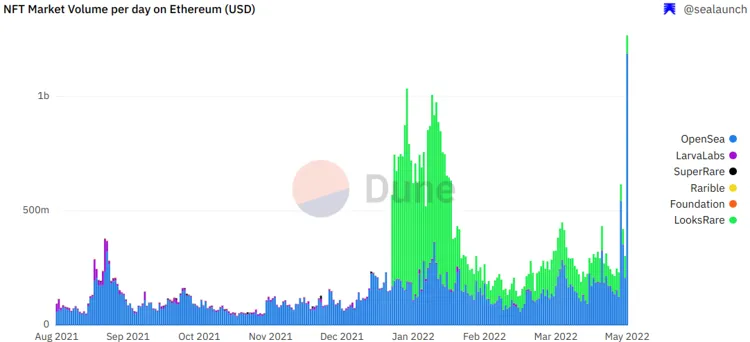

In fact, it shows a massive bump in NFT sales on May 4 when WSJ was reporting the death of them. Take a look at the data below showing NFT market volume per day on just the Ethereum chain.

It’s also worth noting that while Ethereum is the most popular blockchain for NFTs – it’s not the only one. The Tezos blockchain is completely separate from Ethereum transactions and it continues to grow. In fact, Dune Analytics confirms that the volume per day in USD on Ethereum alone is some of the highest volume seen since February 2022. The OpenSea NFT marketplace accounted for nearly $550 million in sales volume on Sunday.

Another analytics platform indexes NFT collections by type. It shows that ‘blue chip’ NFTs estalished by mainstream brands like Bored Ape and Mutant Ape Yacht Club outperform art or gaming tokens by a wide margin. The Nansen Blue Chip-10 index tracking the top ten NFT projects is up 81% this year. The index tracking the top art and gaming NFT collections are down 39% and 49% this year.

So the death of NFT sales is greatly exaggerated. The on-chain data volume doesn’t support the conclusion, as the market continues to expand at an exponential pace. It should come as no surprise that the largest NFT projects are those making the most gains – they’re able to generate press and buzz.

Even music labels like Universal Music Group have bought into the hype. It is launching a Bored Ape Yacht Club band called KINGSHIP and has purchased the rights to several BAYC NFTs’ images to help flesh out the concept.