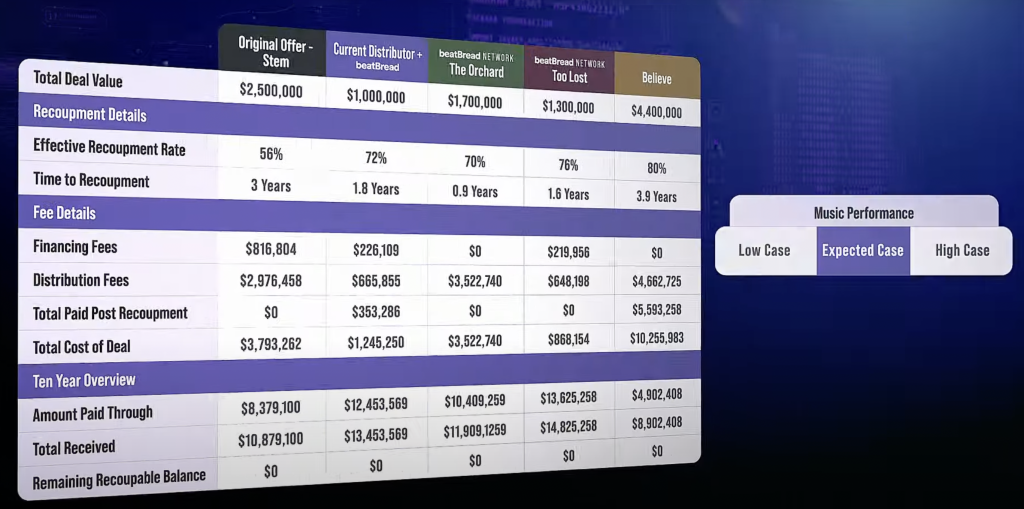

Mock deal terms in beatBread’s Deal Comparison Tool, with an ‘Expected Case’ for content performance during the deal term (photo: beatBread)

For those artists and indie labels lucky enough to have multiple funding offers, beatBread now offers a potentially game-changing tool for weighing competing options. Surprisingly, beatBread’s initial results show that most artists and indie labels (60%) would likely sign a sub-optimal deal before thoroughly vetting their options.

Once upon a time, music financing was a dark art driven by elusive A&R instinct. These days, thankfully, there’s a lot more data behind funding decisions, and labels (and their distributors) aren’t the only game in town. And while indie labels and artists now have more choices, sorting through what is a good and bad deal is difficult, as terms are complex, hard to understand, and fraught with traps and pitfalls. But 2025 might be the year that artists and indie labels gain a serious upper hand.

Last month, we profiled beatBread’s recently released Deal Comparison Tool, a handy platform for weighing a stack of competing music financing offers. In a nutshell, the Tool allows an artist or indie label to view a number of offers side-by-side and weigh those offers according to a variety of parameters. Just recently, DMN partnered with beatBread to further amplify this newly released platform.

Artists and labels can simultaneously compare up to five offers, analyzing upfront cash, fees, recoupment time, and long-term costs. Even better, it allows artists, indie labels, and IP owners to ‘normalize’ offer metrics, which comes in handy if deals are being extended from labels, distributors, publishers, or investors.

Of course, any artist or label can manually compare offers before deciding. The problem is that there are so many variables to weigh, and headline terms don’t tell you how costs and recoupment will likely play out over time.

‘Headline’ deal terms can mask a deal’s actual costs. And understanding outcomes based on catalog and new release performance is extremely difficult.

“Even the most sophisticated executives are sometimes deceived by ‘headline terms’ in a deal,” beatBread CEO Peter Sinclair relayed. “The Deal Comparison Tool gives artists and labels the chance to cut through the fog and get a true understanding of a deal because it links the key terms of a contract to a real range of probable outcomes as music is released and continues to perform.”

Sinclair is hugely confident about the comparison platform’s power. To put it bluntly, he’s not sure there’s a better tool out there for weighing different offers—online or off—which is exactly the confidence you need to release something of this magnitude. Just a few weeks after its launch, the Tool is being used by a significant number of artists and labels to weigh their funding options.

The strange part is that a majority of those using the Tool have chosen not to work with beatBread.

“If beatBread is only funding four, three, or even two out of ten deals we’re helping to vet, then we’re winning,” Sinclair explained. “Artists or indie labels might choose a beatBread partner or select a deal on a party entirely unaffiliated with beatBread.”

But, according to Sinclair, they know they’re signing the best offer.

“I’d rather beatBread develop a reputation as a straight shooter than try and convince an extra three or four people out of ten to take our deal when it’s not the best deal,” he continued.

Sinclair clarified, however, that this isn’t a self-service tool.

Instead, beatBread has experts to help artists and indie labels visualize the trade-offs between deal structures, including revenue splits, term lengths, and long-run costs. Once everything is laid out, determining the “best deal” depends on various factors and preferences, including the artist or indie labels’ expectation of catalog performance, risk appetite, and need for upfront cash vs. long-term cash flow.

Among the early adopters is Dan Englander, founder of indie label KingUnderground.

“When I came to beatBread, I had what I thought were two quite attractive distribution offers,” Englander said. “After seeing the output of beatBread’s Deal Comparison Tool, I realized there were several scenarios where I could have ended up strapped for cash.”

Englander didn’t end up selecting beatBread’s deal, though he did sign with a beatBread partner, which means beatBread co-invested in the deal alongside its partner.

Sinclair noted that Englander’s situation is not unique. The landscape for music financing presents a number of choices to artists and indie labels, but those choices often have many pitfalls and traps.

“It has become standard industry practice to offer headline terms (nominal term length, total deal value) that simply do not reflect how a deal is likely to play out in the real world,” Sinclair added.

“In the worst cases, beatBread’s beta test showed that some independent labels would most likely end up forced into a distress sale after a few years had they taken the seemingly best distribution or label JV offer in front of them.”

“It’s no secret that indie artists and labels have more options than ever,” Sinclair said. “BeatBread’s mission is to help them make the right decision, even if they choose a funding partner other than beatBread.”

Content shared from www.digitalmusicnews.com.