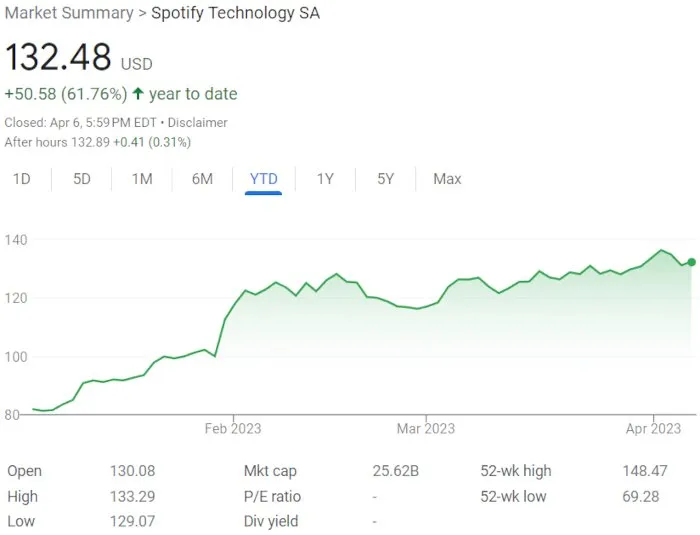

The value of Spotify stock has grown by almost 62% since 2023’s beginning.

After plummeting to an all-time-low price in November of 2022, Spotify stock (NYSE: SPOT) has now turned in an almost 62 percent valuation surge since 2023’s start.

When trading concluded today, Spotify stock – which touched $69.28 per share about five months ago – was worth $132.48 per share. Despite representing a 6.23 percent decline from the same point in April of 2022, the figure reflects a 61.76 percent boost since the beginning of the current year, when SPOT was hovering around $80.

The music streaming platform’s material share-price rebound could be at least partially indicative of an abating downturn across tech stocks, all manner of which have grappled with public-market woes during the past year. Moreover, these same businesses – including Meta, Microsoft, Amazon, and Spotify itself – have in recent months moved to trim spending via personnel reductions and additional steps.

(Meta stock is up 73 percent from the year’s start, compared to a 66 percent hike for Roblox stock, a 19 percent improvement for Snap stock, and a 21 percent jump for Alphabet/Google stock – on top of double-digit gains for Apple, Tesla, Uber, Airbnb, and others yet.)

For Spotify, which kicked off 2023 by parting with six percent of its global workforce, these cost-cutting steps appear to encompass a pause on massive investments, particularly on the podcasting and audiobook sides. Since 2020, the Stockholm-headquartered business has dropped billions in total on programming such as The Joe Rogan Experience and on companies like Podsights and Chartable, to name just some.

But with the Heardle owner’s spending spree having presumably concluded for the time being – execs have likewise axed the Spotify Live offering, the foundation of which was Locker Room – investors are evidently more bullish than they were in the not-so-distant past.

While profitability continues to elude Spotify – which is looking to improve its return on podcasting and crack $100 billion in annual revenue down the line – the service does boast a sizable userbase (489 million monthly active users as of 2022’s end), with 205 million paid users therein, according to its latest earnings report.

Bearing in mind the points, the company is also expanding its paid-promotional programs, and evidence suggests that further price increases could be on the way. Guggenheim’s Michael Morris touched upon the latter point (and particularly the possibility of Spotify’s upping the cost of individual subscriptions in the U.S.) when attaching a buy rating and a $155 target price to SPOT late last month.

Additionally, analysts from Evercore, Rowan Street, and The Guardian Fund have for some time been long Spotify for reasons including the service’s perceived potential as a one-stop audio-entertainment hub.