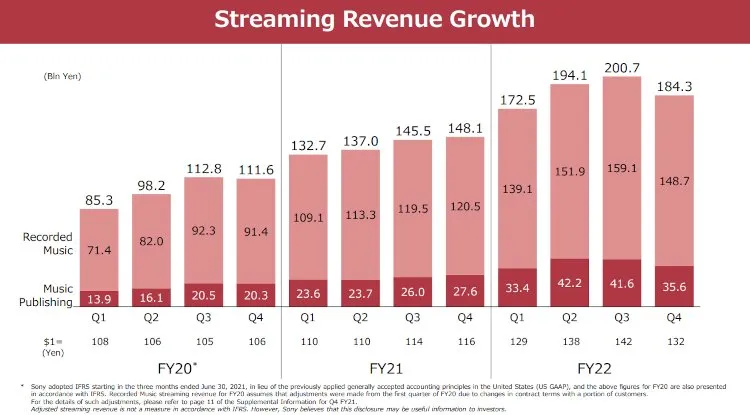

A breakdown of Sony Music Entertainment streaming revenue by quarter. Photo Credit: Sony Group Corporation

Sony Group Corp. generated ¥1.36 trillion ($10.02 billion at the present exchange rate) from its music division during the 2022 fiscal year, when recorded music income swelled by over 32%, according to a new earnings report.

The FY 2022 financials of Sony Music Entertainment (SME) – covering the major label’s showing across the 12 months ending on March 31st, 2023, that is – just recently emerged in Sony Group’s overarching performance breakdown. Excluding “visual media and platform,” which consists of mobile gaming and adjacent operations and has long been grouped into the Japanese conglomerate’s music unit, SME and Sony Music Publishing (SMP) revenue reached about ¥1.16 trillion ($8.52 billion), the company indicated.

Per the analysis, Sony Music’s fiscal-year revenue resulted in large part from continued streaming growth on the recorded side, to which higher-ups attributed ¥598.87 billion/$4.40 billion, up about 29.52%.

Notwithstanding this jump for the entirety of the fiscal year, Sony Music suffered a quarter-over-quarter (QoQ) streaming-revenue decline for publishing as well as recorded during the first three months of 2023, which the report shows delivered about ¥184.27 billion/$1.35 billion (¥148.68 billion/$1.09 billion from recorded and ¥35.59 billion/$261.14 million from publishing), down 8.19% or so.

Meanwhile, non-streaming recorded income came in at ¥286.27 billion/$2.10 billion (up 38.69%) for the fiscal year and at ¥73.88 billion/$542.31 million (up 31.12% YoY) for the initial quarter of 2023, according to the document.

Within the latter sum is ¥28.41 billion/$208.46 million from vinyl and other physical releases (a 37.16% YoY improvement), ¥8.67 billion/$63.61 million from permanent downloads (up 3.04% YoY and 9.88% QoQ), and ¥36.80 billion/$269.99 million from “other” such as licensing, merch, and live shows (up 35.21% YoY).

Behind the growth, execs pointed in part to a positive impact from foreign exchange rates, and for Q1 2023, SME artists’ bestselling projects (by total revenue) were SZA’s SOS, Miley Cyrus’ Endless Summer Vacation, Harry Styles’ Harry’s House, Pink’s Trustfall, and Depeche Mode’s Memento Mori, respectively.

Shifting to publishing, Sony Music Publishing is said to have brought in ¥65.96 billion/$483.92 million on the quarter (up 22.17% YoY) and ¥276.67 billion/$2.03 billion on the fiscal year (up 38.10%). And as of March 31st, SMP’s catalog of owned and administered works encompassed 5.76 million songs – up from 5.46 million songs at the end of March of 2022 and 5.03 million songs at March’s end in 2021, the resource shows.

The aforementioned visual media and platform segment produced ¥203.01 billion/$1.49 billion during the fiscal year (down 12.27% YoY), rounding out the initially highlighted ¥1.36 trillion in annual music revenue.

Finally, Sony Music’s operating income grew 24.73% to hit ¥263.11 billion/$1.93 billion for the year and jumped 21.23% YoY to crack ¥60.44 billion/$443.36 million for the quarter. Looking forward to the 2023 fiscal year, execs have forecasted ¥1.41 trillion/$10.34 billion in revenue for Sony Music (which recently received a multimillion-dollar damages payment from TikTok rival Triller) and visual media/platform as well as ¥265 billion/$1.94 billion in operating income.