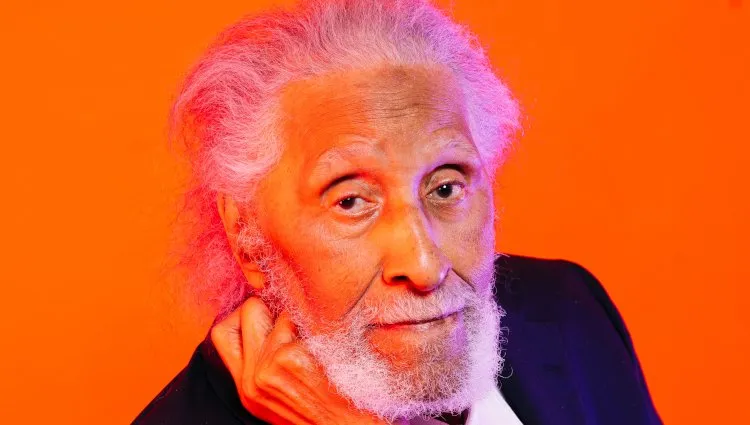

Sonny Rollins has sold his catalog to Reservoir Media. Photo Credit: Mamadi Doumbouya

Reservoir Media has officially acquired the song rights of “renowned saxophonist and living jazz icon” Sonny Rollins.

New York City-based Reservoir (NASDAQ: RSVR) and 92-year-old Sonny Rollins unveiled the deal – which extends to both the publishing and recorded rights of “The Saxophone Colossus” – this morning. Rollins has crafted north of 60 albums, including 1957’s Saxophone Colossus and 1962’s The Bridge, throughout his decades-long career.

Additionally, the two-time Grammy winner has collaborated and recorded with the likes of Thelonious Monk (including on 1957’s Brilliant Corners), Miles Davis (1957’s Bags’ Groove, among several others), and Dizzy Gillespie (1959’s Sonny Side Up), to name just some.

Though Reservoir’s formal release about the Sonny Rollins catalog sale doesn’t identify the precise ownership details and scope of the agreement, the professional behind “Oleo” indicated that he’s “happy” with the deal.

“I’m happy that Reservoir will be helping to maintain my musical legacy, which was created in concert with so many great musicians I’m proud to be associated with,” Rollins communicated of the transaction, the financial terms of which haven’t been publicly revealed.

And in remarks of his own, Reservoir president and COO Rell Lafargue acknowledged his goal of bringing Rollins’ body of work to a new generation of fans.

“I first learned of Sonny through his music, playing ‘St. Thomas’ as a young jazz student, and it’s incredibly meaningful that Reservoir and I can now commit to preserving Sonny’s musical legacy and amplifying his contributions to the artform for audiences old and new,” Lafargue relayed in part.

For Reservoir, today’s investment represents the latest in a long line of catalog acquisitions, as well-known and emerging players alike continue to pour capital into song rights. January saw the business announce a tie-up (including future releases) with “Runaround Sue” singer-songwriter Dion, for instance, after taking a stake in the work of “Sing, Sing, Sing” songwriter Louis Prima in October.

Meanwhile, Reservoir founder and CEO Golnar Khosrowshahi pointed to a “robust” deal pipeline during her company’s Q4 2022 (the third quarter of the fiscal year) earnings call earlier this month. “Our pipeline is robust at nearly $2.3 billion in total value for prospective deals,” the exec stated.

In the overarching performance analysis, Reservoir posted total revenue of $29.93 million for October, November, and December of last year, up about 16 percent from the same period in 2021. As in prior quarters, publishing income ($20.2 million, up approximately 14 percent YoY) accounted for the majority of the figure, while recorded revenue improved by about one percent to hit $7.6 million, according to the breakdown.

But Reservoir also suffered a $4.41 million net loss on the quarter, when administration expenses swelled from $6.73 million to $8.04 million. At the time of this writing, Reservoir stock was trading for $6.63 per share, reflecting a roughly one percent dip from Tuesday’s close.