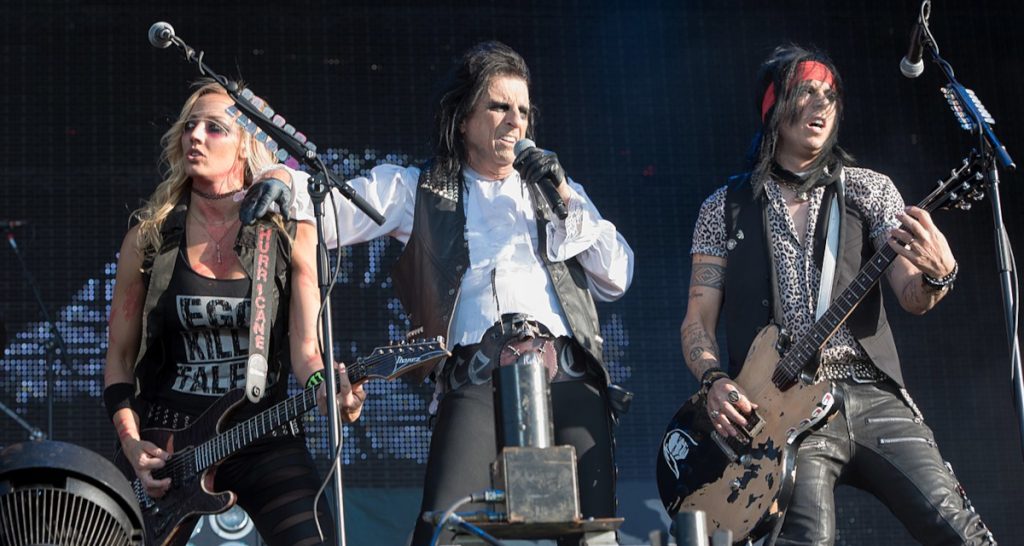

A performance from Alice Cooper at Wacken Open Air, one of the festivals under the Superstruct banner. Photo Credit: Frank Schwichtenberg

About four months after KKR revealed the acquisition of Superstruct Entertainment, CVC has officially taken a stake in the European concert giant.

Luxembourg-headquartered CVC just recently announced that it had moved to get in on the live entertainment action, after the BMG stakeholder KKR in June unveiled the reportedly $1.4 billion purchase of Superstruct.

Founded in 2017, the events organizer is said to own north of 80 festivals, among them Wacken Open Air and Tinderbox, held across 10 countries. KKR’s initial buyout disclosure didn’t mention CVC, but the latter says it’s “invested alongside” the original purchaser, with the appropriate transaction having “now closed.”

Unsurprisingly, the parties opted against diving into the financials associated with CVC’s involvement. However, CVC, which trades under the same ticker on the Euronext Amsterdam and is said to have over $200 billion in assets under management, is poised to help Superstruct on “its mission of creating best-in-class live experiences,” according to the brass-tacks release.

That refers in part to “working closely with entrepreneurs, creative visionaries and business-minded professionals” to assist Superstruct in “driving innovation and setting the standards for live entertainment,” the overview-focused text proceeds.

While the former Stage Entertainment owner CVC’s precise contributions to the post-sale Superstruct remain to be seen, it’s worth noting that the investment firm’s portfolio extends to multiple digital marketing businesses, Authentic Brands Group, at least one travel agency, and a whole lot else.

Bigger picture, despite festival-attendance woes, the collapse of Festicket, and the ongoing dominance of Live Nation, KKR and CVC are hardly alone in looking to cash in on the live space.

(Incidentally, Live Nation’s shares cracked another 52-week high, this time of $119.40 apiece, yesterday. Still staring down a Justice Department antitrust suit, the Ticketmaster parent is scheduled to post its third-quarter earnings on November 12th.)

CTS Eventim over the summer closed its approximately $330 million purchase of various Vivendi ticketing and festival assets outside France. Also on the ticketing front, notwithstanding Festicket’s mentioned demise, the likes of TickPick and Seat Unique have scored sizable investments on the year.

In keeping with the apparent investor optimism fueling those investments, another ticketing platform yet, Dice, is reportedly exploring a sale that would value it in the hundreds of millions of dollars. Meanwhile, though the process has experienced multiple delays, StubHub’s sought $16.5 billion IPO reportedly remains on the table.