Back in 1965 a husband and wife in Omaha were facing a difficult – but very common – problem. A problem that is fairly common for many middle-aged couples: How do you properly plan for retirement? On the plus side, thanks to diligent saving habits and a small inheritance Dorothy and Myer Kripke were actually way ahead of most of their peers when it came to retirement planning. Impressively, by 1965 the Kripkes had managed to sock away roughly $67,000. FYI, that’s equal to roughly $650,000 today after adjusting for inflation.

That was the good news. The bad news was that they needed to protect and grow the savings so it would still be there when they were ready to retire in a decade or two. After months of stressful debating, Dorothy offered her husband some simple advice:

“Myer, invest the money with your friend, Warren.”

This friend Dorothy was referring to was a 35-year-old neighbor who had recently gained a positive local reputation for managing money in their small town of Omaha, Nebraska. The Kripkes had come to know the man over casual bridge games and holiday get-togethers. Myer was too embarrassed to ask for help. He eventually relented. Thank God.

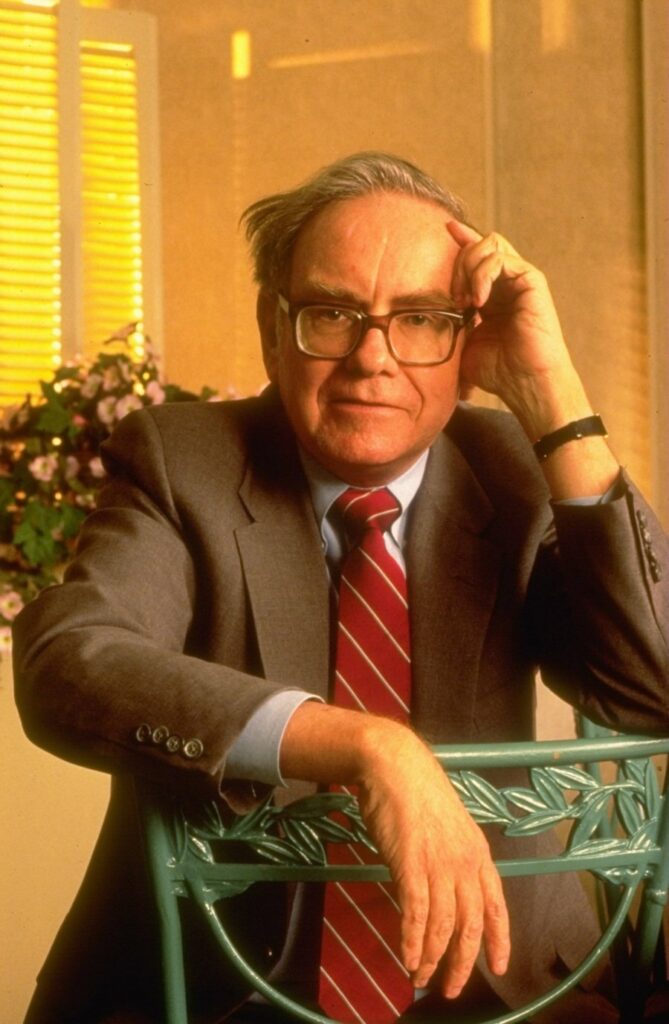

Their neighbor agreed without hesitation. His name?

Warren Edward Buffett

(Photo by Rob Kinmonth/Getty Images)

As you have probably ascertained by now, Dorothy and Myer Kripke accidentally stumbled upon a man who would eventually be considered one of the greatest financial investors of all time. A man whose local investment business would one day manage roughly $500 billion in assets. A man who is the fifth richest person in the world today with a personal net worth of $110 billion.

Of course, we are talking about the Oracle of Omaha himself, Warren Buffett.

Myer Kripke was very hesitant at first to ask the young upstart money manager to handle their life savings. For one thing, he thought it would be seen as a major imposition. Secondly, Myer worried about mixing business and friendships. But most importantly, he knew that at the time Warren’s minimum investment limit was $150,000. So there was no point in even bringing it up!

Dorothy and Myer Kripke

Thankfully, Dorothy didn’t let those hesitations get in the way. But believe it or not, Myer resisted reaching out to Warren for THREE YEARS! Finally, Myer relented. Warren agreed to manage the money without hesitating for a second. In Warren’s own words:

“I liked Myer [and] I wanted people who if it went bad, we could still be friends.“

Fortunately for both men, things did not go bad. Over the next thirty years, Warren’s business expanded and at exponential pace. And along the way, Myer and Dorothy Kripke’s $67,000 life savings ballooned just as quickly. In Myer’s own words:

“We got in fairly early with a modest amount of money. Then it mushroomed like an atomic bomb.“

Pretty soon, the Kripkes were millionaires. Then multi-millionaires. Incredibly, by the mid 1990s, their $67,000 life savings had mushroomed into more than $25 million. That’s the same as roughly $40 million today, after adjusting for inflation.

In the mid-1990s, Berkshire Hathaway’s stock price hovered between $20,000 and $40,000 per share. Let’s split the difference and use $30,000 per share to estimate how many shares the Kripkes owned. If the Kripkes were worth $25 million in the mid 1990s at $30,000 per share, that means they owned around 833 shares of Berkshire Hathaway. If they never sold a single share share, at the time Dorothy died in September 2000, they would have been worth $50 million. By the time Myer died in May 2014, with Berkshire stock trading at $215,000 per share, their 833 shares would have been worth $180 million. Someone who owns 833 shares of Berkshire Hathaway today would be worth…

$358,190,000

Warren Buffett – Dexter Shoes / Dimitrios Kambouris/Getty Images

That’s $358 million. From a $67,000 investment.

So how did Myer and Dorothy’s lives change as they become millionaires, then multi-millionaires and eventually $50-150 millionaires?

Amazingly, as they became wealthy, Myer and Dorothy never stopped living a very humble life. They never bought a house. They continued renting a modest three bedroom Omaha apartment for $900 a month. Myer, an ordained rabbi, continued working at his local synagogue earning a salary of $30,000 a year.

The Kripke’s biggest indulgence turned out to be philanthropy. Throughout their lives, this amazing couple donated millions of dollars to a number of charities. They donated $7 million to help rebuild a library at the Jewish Theological Seminary in Manhattan. The Kripkes first met each other as students outside this very same library decades ago. They eventually donated an additional $8 million to their alma mater.

Dorothy Kripke died in September of 2000 at the age of 88 and Myer died May 2014 at the age of 100.