Sony Music Entertainment generated north of ¥194 billion (currently $1.3 billion) during Q3 2022, according to a new earnings report. Photo Credit: Sony Group

Sony Music Entertainment (SME) recorded a nearly 33 percent year-over-year revenue hike (as well as a 13.26 percent quarterly increase when factoring exclusively for recorded and publishing) during the three months ending on September 30th, according to a newly released earnings report.

The Big Three label’s Q3 2022 (and Q2 FY2022) showing came to light in a performance breakdown from the overarching Sony Group. Per the analysis, the conglomerate’s music segment generated ¥359.32 billion (about $2.42 billion at the present exchange rate) during the three-month stretch.

As usual, the lion’s share of the revenue (¥356.93 billion/$2.41 billion) is attributable to external customers, with the remaining ¥2.39 billion ($16.13 million) having derived from intersegment sales to various Sony Group divisions.

Also in keeping with Sony’s past earnings reports, music’s total revenue encompasses contributions (¥59.48 billion/$401.19 million this time around) from “visual media and platform,” or “the production and distribution of animation titles and game applications, and various service offerings for music and visual products.”

In any event, the aforesaid ¥356.93 billion/$2.41 billion in music revenue signifies a 32.91 percent improvement from Q3 2021, and the sum that derived solely from recorded music and publishing, ¥297.45 billion ($2.01 billion), reflects a noteworthy 46.09 percent jump from the identical period in 2021.

(Besides the below-described increase in income from streaming subscriptions, execs highlighted the “impact of foreign exchange rates” when explaining SME’s bolstered Q3 sales and operating income, the latter of which is said to have further benefited from a ¥5.7 billion/$38.45 million payment from “litigation settlements received in relation to lawsuits.”)

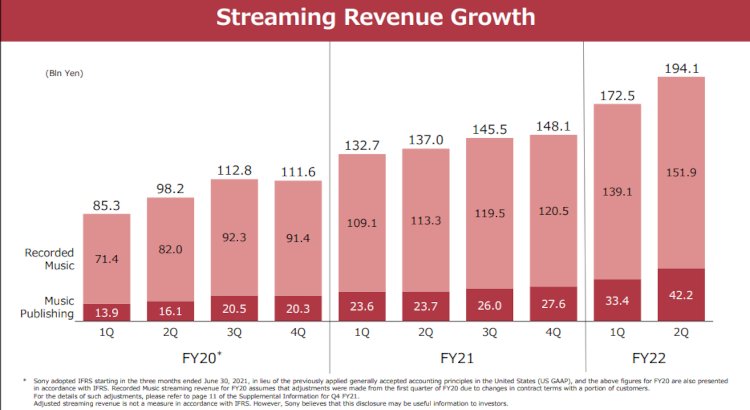

Predictably, continued streaming growth drove a large chunk of the gains, to the tune of a 34.10 percent YoY boost in recorded music revenue in the category, at ¥151.93 billion ($1.02 billion). Execs took the opportunity to emphasize that “an average of 48 of our songs ranked in the top 100 songs in Spotify’s weekly global music rankings for the first half of the current fiscal year,” against an average of 36 throughout the prior fiscal year.

Nevertheless, Sony Music managed to improve “other” recorded music revenue, which includes physical sales, by 67.50 percent from Q3 2021, the document shows, with the period having delivered about ¥72.03 billion ($485.70 million) in the category.

But income resulting specifically from CDs, vinyl, and other physical products, despite growing 20.24 percent year over year, dipped on a quarterly basis to ¥24.35 billion ($164.28 million), the report shows. However, Sony Music Entertainment’s download income (¥14.14 billion/$95.39 million) more than doubled from Q3 2021 and nearly did the same from Q2 2022.

Rounding out the “other” category is ¥33.55 billion ($226.34 million) from sync and public performance licensing as well as merchandise; the figure likewise more than doubled from Q3 2021 and improved by 23.03 percent from the prior quarter.

Additionally, Sony Music Publishing is said to have achieved a 55.34 percent YoY revenue hike during Q3 2022 by pulling down ¥73.49 billion ($495.44 million). Within the publishing sum, streaming rose by 26.23 percent QoQ to hit ¥42.19 billion ($284.52 million), per the breakdown.

Sony Music’s bestselling projects (by revenue) for Q3 2022 include Beyonce’s Renaissance, Harry Styles’ Harry’s House, Future’s I Never Liked You, and Doja Cat’s Planet Her, respectively. Looking forward to the remainder of the fiscal year (concluding on March 31st), execs upped their annual sales guidance for the music segment to ¥1.37 trillion ($9.24 billion), besides elevating the operating income forecast to ¥265 billion ($1.79 billion).