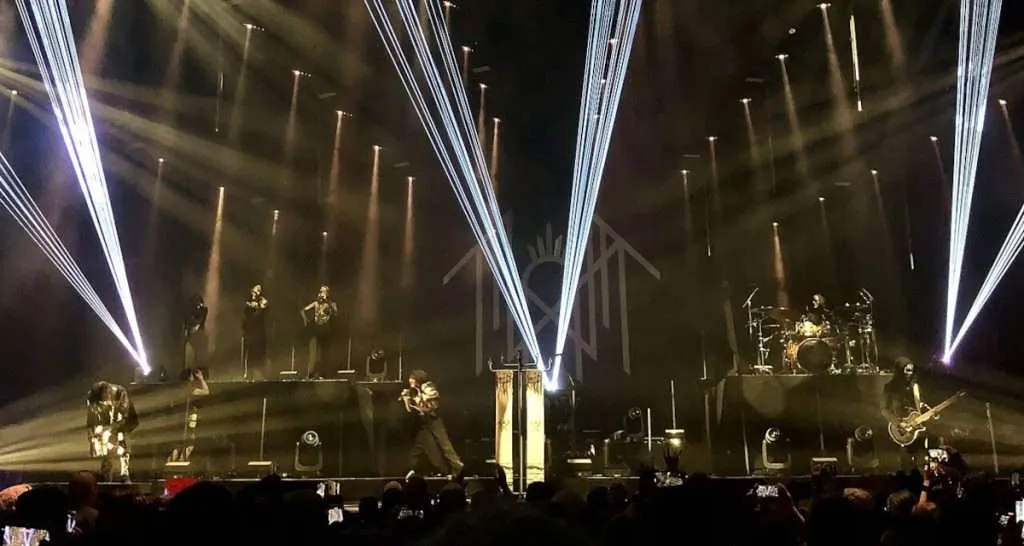

A live performance from Sleep Token, whose Even in Arcadia was one of the top-selling Sony Music releases of Q2 2025. Photo Credit: Excel23

Sony Music Entertainment (SME) achieved Q2 2025 revenue growth despite a streaming decline on the recorded side, according to a newly released earnings report.

That fiscal-first-quarter report comes from the overarching Sony Group Corp. and, as with prior performance breakdowns, contains a number of moving parts. Perhaps most significantly, the conglomerate collects revenue in a variety of currencies but reports in yen.

This time around, execs emphasized the point’s material impact on the period’s music financials; the below conversions reflect the current yen-dollar exchange rate.

Next, the business groups core Sony Music revenue with that attributable to “visual media and platform.” Housing certain mobile apps, movies, and more, the latter is best omitted to get a better idea of actual music revenue.

(One visual media and platform example: Demon Slayer: Kimetsu no Yaiba – The Movie: Infinity Castle, which is said to have generated north of $119 million/¥17.6 billion at the Japanese box office since its July 18th premiere.)

All told, then, Sony Group identified $3.11 billion/¥458.95 billion in external music revenue for April, May, and June 2025, reflecting a 5.3% year-over-year improvement. Less visual media and platform, though, revenue came in at $2.71 billion/¥400.17 billion, for comparatively modest YoY growth of 1.1%.

Digging into the latter sum, Sony Music’s across-the-board recorded revenue technically increased by close to 1% YoY at $2.04 billion/¥301.49 billion.

Therein, recorded streaming revenue slipped slightly YoY to $1.33 billion/¥196.02 billion, compared to a 10.6% YoY hike for physical formats including vinyl ($176.87 million/¥26.09 billion).

“On a U.S. dollar basis, streaming revenues for the quarter increased 7% year-on-year in Recorded Music and 8% in Music Publishing,” higher-ups elaborated, noting as well a $188.45 billion/¥27.80 billion exchange-rate hit absorbed by the music segment during Q2.

Rounding out recorded music, permanent downloads revenue jumped 52% YoY to $66.64 million/¥9.83 billion, with licensing, merch, and live performances contributing a combined $471.47 million/¥69.55 billion (down 4.2% YoY) on the quarter.

By revenue, Sony Music’s top-selling second-quarter projects were Bad Bunny’s Debí Tirar Más Fotos, SZA’s SOS, Sleep Token’s Even in Arcadia, Tate McRae’s So Close to What, and Bad Bunny’s Un Verano Sin Ti, respectively.

Shifting to publishing, where Sony Music Publishing’s catalog encompassed 6.63 million works as of March 31st, revenue grew 2.1% YoY to $669.04 million/¥98.69 billion.

Bearing in mind the above-mentioned exchange-rate impact, publishing streaming revenue dipped 0.4% YoY to $384.72 million/¥56.75 billion.

Lastly, music’s overall operating income rose 8.1% YoY to $629.17 million/¥92.81 billion; visual media and platform made up “slightly more than 10%” of the profit.

Looking ahead to the remainder of the fiscal year – meaning the next nine months – Sony Music increased its forecast slightly to $12.88 billion/¥1.87 trillion, citing an anticipated recorded music boost “resulting mainly from an increase in revenues from streaming services.”

Content shared from www.digitalmusicnews.com.