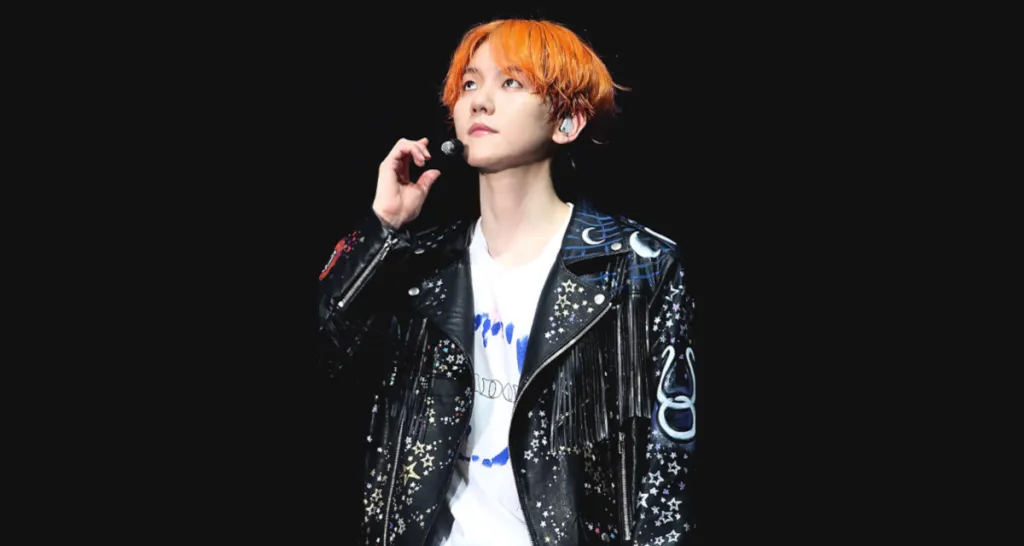

A live performance from Exo member Baekhyun, one of the top-selling Warner Music Group artists of Q2 2025. Photo Credit: Light Monde

Warner Music Group (WMG) has reported $1.69 billion (up 9% YoY) in revenue for Q2 2025, which delivered paid streaming growth and a small physical sales dip.

The major posted those calendar Q2 financials, covering the third quarter of its fiscal year, today. As usual, recorded music accounted for the lion’s share of revenue, growing 8% YoY to $1.35 billion during the three-month stretch.

Therein, streaming contributed $895 million (up 4% YoY), which, in keeping with broader market trends, reflects a 5% YoY improvement on the subscription front ($674 million in total revenue) and a 1% YoY ad-supported decline to $221 million. (WMG once again acknowledged a hit, this time at $14 million, from BMG’s ADA split.)

Elsewhere on the recorded side, physical formats including vinyl put up $119 million (down from $120 million in Q2 2024), and the long-slipping permanent downloads category still managed to kick in $34 million.

Additionally, licensing revenue spiked 23% YoY to $111 million – the boost was “driven by licensing deals primarily in the U.K. and China, and [the] timing of other copyright infringement settlements.” And artist services and expanded rights achieved a similar year-over-year growth percentage to crack $195 million.

Interestingly, despite physical’s flat showing and well-documented streaming plateau concerns in the States, WMG emphasized its Q2 market-share growth in the U.S.

In hard numbers, stateside recorded music revenue grew 3.7% YoY to $536 million, compared to a 15.5% YoY spike for its publishing counterpart ($186 million). For reference, Warner Music’s total U.S. revenue fell roughly 3% YoY during the nine months ended June 30th, with 2025’s opening quarter having brought both recorded and publishing contractions, per the financials.

Shifting to Warner Chappell, WMG pointed to a 10% YoY Q2 2025 publishing revenue hike ($336 million total), including $204 million (up 5% YoY) from streaming and other digital sources.

Performance followed with $58 million (up 12% YoY due chiefly to European concerts), with sync ($54 million, up 29% in part because of infringement settlements), mechanical ($16 million, up 23% YoY), and other sources ($4 million, flat YoY) closing out publishing.

All told, WMG disclosed second-quarter operating income of $169 million (down 18% YoY) and a net loss of $16 million.

As for Warner Music’s Q2 earnings call, execs mainly reiterated existing information and strategic details; CEO Robert Kyncl confirmed “deep discussions” with DSPs on superfan tiers, but didn’t reveal particulars.

Company brass also underscored plans to keep on cutting costs, accelerate acquisitions via JVs and otherwise, and pursue growth in high-potential markets.

On the latter front, WMG today announced yet another executive-level shift, tapping PCCW vet Lo Ting-Fai (aka Lofai) to serve as Warner Music APAC president effective August 11th. “All of the company’s recorded music territory heads across the Asia-Pacific region will report to Lofai,” the major spelled out.

Also during the call, one analyst asked about (but didn’t receive too specific an answer regarding) rapid-fire acquisitions’ impact on financials. Of course, the often-overlooked organic-growth topic is relevant for all three majors, each of which is rather aggressive in scooping up companies as well as IP.

In any event, with today having brought a $0.19-per-share dividend announcement as well, Warner Music stock (NASDAQ: WMG) was up 2.1% at the time of writing, when shares were worth $30.65 a pop.

Content shared from www.digitalmusicnews.com.