Photo Credit: FIMI.it

Italy becomes the third-largest EU music market behind Germany and France. Italian recorded music revenues rose by 8.5% in 2024.

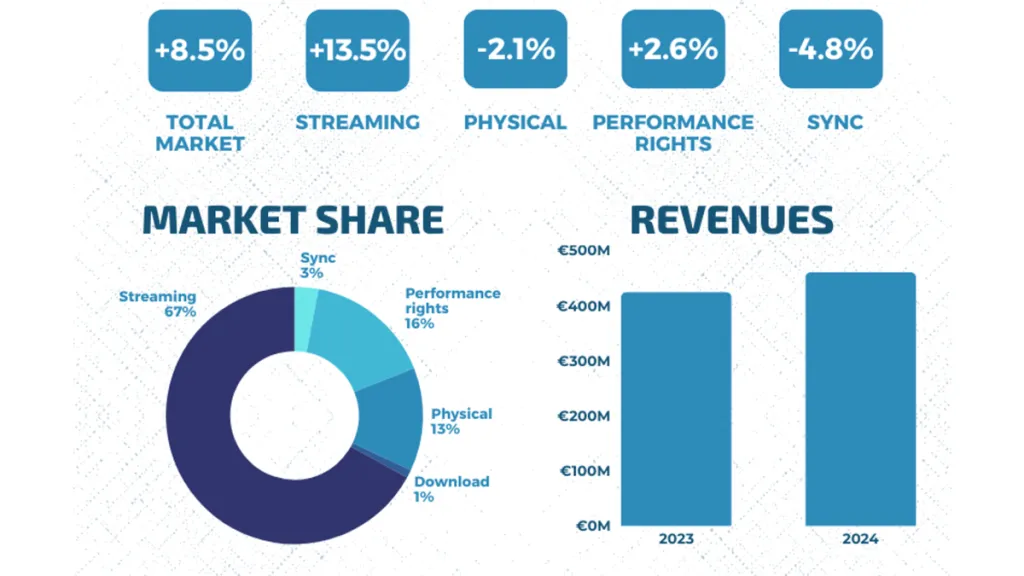

For the seventh consecutive year of growth, the Italian recorded music market firmly establishes its vitality with an overall increase of 8.5% last year. The growth positions Italy as the third-largest music market in the EU after Germany and France.

The driving force behind the growth is streaming, representing 67% of total revenues and recording 13.5% growth — or 308.1 million euros. With a total amount of 95 billion streams in 2024, up 31% from 2023, the most relevant segment is represented by subscriptions, which recorded an increase of 17.1%. Ad-supported revenue remains stable, recording a modest +0.4%. This data confirms the growing interest of Italian consumers in subscription-based models.

The video streaming segment also recorded a significant increase of 14.1%, demonstrating how audiovisual content continues to represent an important lever for music consumption. Despite the physiological decline in downloads (down 12.7%), the Italian digital market as a whole reached 312.2 million euros, with a growth of 13.1% compared to 2023.

However, the physical market still plays an important role, accounting for 13% of total revenues, although overall it recorded a 2.1% decline. This slowdown is due to the replacement of the Italian Government’s Culture Bonus for income brackets and high-performing students, which have provided less incentive for purchasing recorded music.

Despite the overall decline in the segment, vinyl remains the preferred physical medium format for Italian music lovers, with a growth of 6.8%. This is the sixth consecutive year of growth for the format that places Italy as the eighth-largest market worldwide.

Performance rights also recorded an increase of 2.6%, reaching 74.8 million euros and covering 16% of total revenues, representing the second source of revenues in the Italian record market after streaming. Despite the decline in the private copy area due to the decline in electronic devices’ sales, the overall figure testifies to the growing importance of royalties deriving from the public use of music.

On the contrary, sync recorded a 4.8% decline, bringing the segment’s share to just 3% of total revenues. This is the result of an increasingly intense competition in the music listening market and a slight reduction in investments in this area.

Royalties from Italian music export performed very well, reaching a total of 27.95 million euros in 2024, marking an increase of 13.8%. The digital segment is naturally the main driver of this growth, with a significant increase of 24.4%.

The 2024 data confirms the structural transformation of the Italian market, increasingly oriented towards digital and with consumption models based on access rather than ownership. The continuous expansion of paid streaming underlines a change in the listeners’ habits, with music in 2024 being more oriented towards new releases than the catalog — 82% of streams came from songs released from 2010 onwards.

Content shared from www.digitalmusicnews.com.