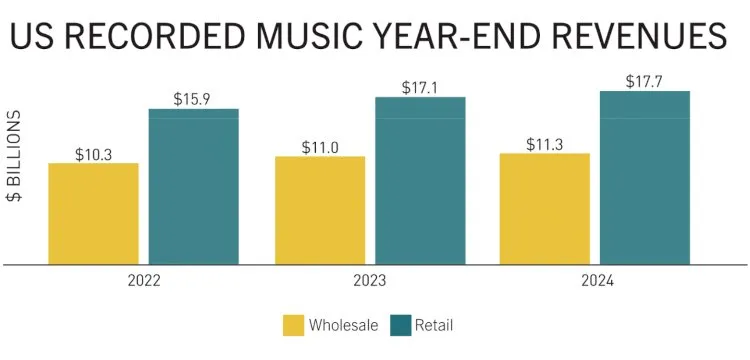

A breakdown of U.S. recorded music industry revenue in 2022, 2023, and 2024. Photo Credit: RIAA

Paid on-demand music streaming subs hit 100 million to close out 2024, when overall streaming revenue increased by a modest 3.6% year over year.

These and other recorded-market stats come from the RIAA’s newly released 2024 year-end report. According to that breakdown, the mentioned 100 million on-demand subs mark a 3.3% YoY boost and, against the backdrop of slow-but-fairly-steady price bumps, delivered $10.69 billion in recorded revenue (up 5.3% YoY).

(Specifically, the reported streaming subs here reflect the “average number of subscriptions,” the text clarifies. However, DMN Pro’s streaming market-share data estimates for multi-user plans to provide a more comprehensive look at actual paid subscribership figures in the States.)

Meanwhile, the RIAA attributed $1.83 billion to ad-supported on-demand streaming (down 1.8% YoY) and a 2.3% YoY revenue slip to paid limited-tier streaming subs ($998.3 million), besides reiterating SoundExchange’s previously announced $1.05 billion in distributions for non-interactive digital plays (up 4.9% YoY).

Along with $306.5 million from different ad-supported sources, that comes out to almost $14.88 billion, reflecting the initially highlighted 3.6% YoY improvement. In other words, the streaming plateau is alive and well in the States, and it’ll be interesting to see how effective superfan tiers are at driving accelerated revenue results.

Also alive and well (but attracting comparatively little attention) is a vinyl plateau. Previously, different data suggested a possible stateside growth slowdown for the long-resurging format, which is encountering cooling sales in different markets as well.

All told, the RIAA identified 43.6 million vinyl units shipped (not necessarily sold to individual customers) for 2024, up 1% YoY. At estimated retail value – again, not necessarily the prices shoppers paid – the format generated $1.44 billion last year, up 6.9% YoY, the analysis shows.

CDs, for their part, are said to have experienced a 1.5% YoY sales-volume jump (to 32.9 million units), for $541.1 million (up 0.7% YoY) in revenue.

Unsurprisingly, permanent downloads’ years-running decline continued (for $369.7 million in revenue across the board, down 14.9% YoY) in 2024, and the RIAA attached $412.6 million to the narrowly defined sync category (up 2.5% YoY).

Addressing the data, both RIAA CEO Mitch Glazier and research VP Matt Bass touted forthcoming opportunities to unlock additional revenue.

With Spotify Deluxe and more on the way, Glazier emphasized “new opportunities that boost incomes for artists and diverse revenue streams to grow the pie for everyone.” Bass, for his part, touched on upcoming “creative opportunities for fans to support and connect with their favorite artists’ music.”

Last week, the BPI disclosed the U.K.’s recorded-market particulars for 2024, and the IFPI is set to shed light on global 2024 figures in an annual report tomorrow.

Content shared from www.digitalmusicnews.com.