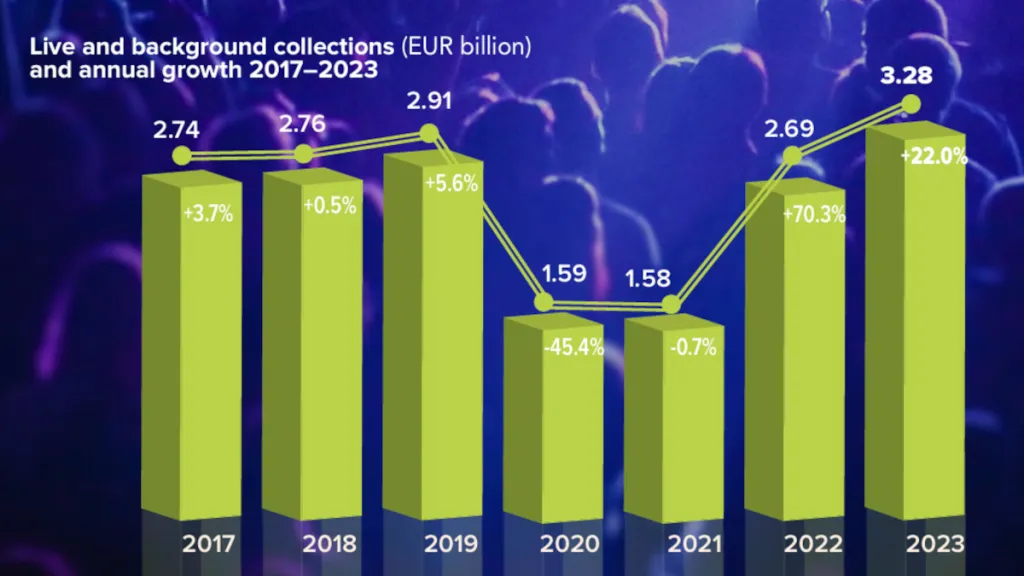

Total CISAC member collections from live and public performance usages, 2017-2023. Photo Credit: CISAC

CISAC member societies achieved 7.6% year-over-year collections growth to hit a record $14.14 billion/€13.09 billion in 2023 – including $12.69 billion/€11.75 billion specifically for music usages (also up 7.6% YoY).

The International Confederation of Societies of Authors and Composers (CISAC) revealed these stats in its 2024 annual report, which is based on data from 227 member CMOs. Diving directly into the relevant numbers, the €13.09 billion in total collections marks a nearly 30% improvement from pre-pandemic 2019, the resource shows.

Behind the 2023 sum for music, $3.65 billion/€3.38 billion derived from television and radio (down 28% from 2019; the same category slipped about 4% YoY for all collections), $4.89 billion/€4.53 billion came from digital (up 2,463% from 2019), and $3.31 billion/€3.06 billion was attributed to live and public performance usages (up 345% from 2019 and, once again for total collections, 22% YoY).

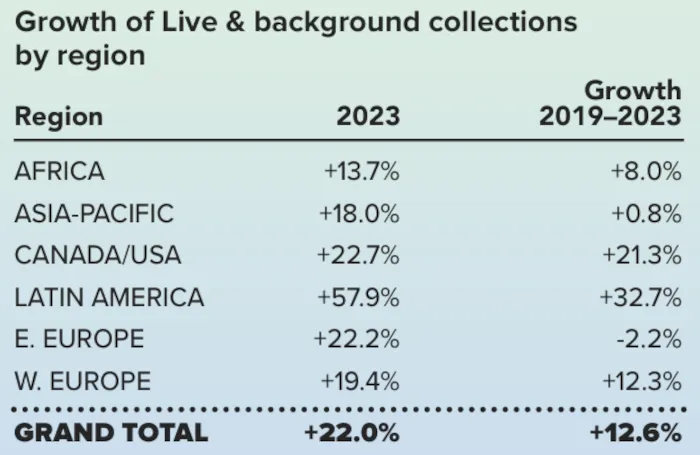

Like total collections, overall live/background has now rebounded well past 2019 levels ($3.14 billion/€2.91 billion) due in part to recoveries throughout Latin America and Asia-Pacific, according to the analysis.

Furthermore, an increasingly AI-focused CISAC noted that live music had continued to outpace the public performance category’s other areas for growth across 2019 and 2023 – with, for instance, a 24% expansion (from 2019) for live to $1.11 billion/€1.031 billion compared to a 6.1% improvement for background music (€1.032 billion).

At the risk of diving too far into the breakdown – CISAC’s 2024 report runs over 60 pages and covers a substantial amount of ground – the data suggests that live/background recoveries are still picking up in regions like the aforementioned Latin America, Asia-Pacific, and Eastern Europe.

A telling recap of CISAC members’ 2023 live and background collections by region. Photo Credit: CISAC

Meanwhile, digital’s 9.6% YoY royalties jump (overall and for music in particular) did, of course, derive in large part from streaming.

However, against the backdrop of relative subscribership plateaus in established markets, it was the category’s first single-digit boost since at least 2019 and marked a fall from 35.1% YoY growth in 2022, the resource indicates.

Closing by rounding out 2023’s music-specific collection figures, CD and video kicked in $410.36 million/€380 million (down 40% from 2019), private copying contributed $300.18 million/€278 million (up 59% from 2019), and other sources generated the remaining $136.08 million/€126 million (up 22% from 2019).

Digital accounted for 87.2% of 2023’s music collections, and in terms of percentage royalties growth by region, Latin America (up 26.2% YoY to $749.45 million/€694 million) and Europe (up 8.3% YoY to $6.49 billion/€6.01 billion) led the pack, according to the report.

Lastly, the top-10 countries by music collections (save Japan and Spain, both down 3% YoY) turned in largely modest growth, with stronger results in Italy (up 22.3% to $539.95 million/€500 million) and South Korea (up 9.6% YoY to $323.94 million/€300 million).