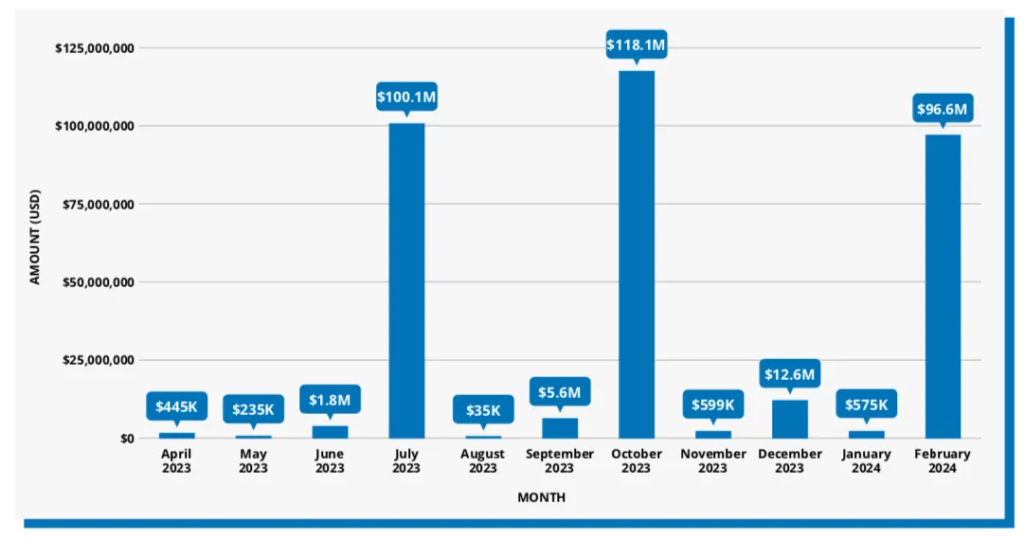

Spotify (SPOT) Stock Insider Sales Cumulative Value by Month, April 2023-February 2024 (photo: Digital Music News)

Following the release of Spotify’s Q4 2023 earnings report, insiders including CEO Daniel Ek sold a total of almost $100 million worth of company stock. Amid a push for profitability – and as shares continue to hover around a 52-week high – what does the selloff mean for the streaming giant’s 2024?

Spotify (NYSE: SPOT) posted its Q4 2023 financials on Tuesday, February 6th, reporting the addition of 10 million subscribers from the prior quarter and a smaller-than-expected operating loss. Against the backdrop of the business’s push for profitability, the market responded positively to the results; SPOT rose from the low-$220s at the week’s beginning to surpass the $240 mark.

But Spotify execs and officers acted on SPOT’s valuation spike as well. On the 7th and the 8th, insiders sold a cumulative $96.64 million worth of company stock, according to Securities and Exchange Commission (SEC) regulatory filings. For multiple reasons – among them SPOT’s value fluctuations in recent years – the moves are spurring questions about the trajectory not only of Spotify stock, but of the company itself.

Report Table of Contents

I. Spotify Insiders’ Post-Earnings Selloff: Who Sold What, and Should Investors Be Worried?

II. Graph: Spotify Stock Insider Sales’ Cumulative Value by Month, April 2023 – February 2024

III. Spotify Stock’s Long and Winding Road to Early February’s 52-Week High

IV. Graph: Spotify Stock’s Per-Share Value, 2018-24

V. Spotify Stock’s 2024 Outlook – Where Does SPOT Stand As Profitability Takes Center Stage?

VI. Spotify Stock by the Dates: A Timeline of Insider Sales, Share-Price Fluctuations, and Related Developments

If you’d like to download this report, simply send an email to support@digitalmusicnews.com.