During 2021 and 2022, capital rushed into non-fungible token (NFT), cryptocurrency/blockchain, metaverse, and wider music Web3 startups in the music industry. But how are these businesses faring amid dramatic funding and market changes?

Following the hype surrounding music Web3 startups and their vast capital raises, how are these companies doing? With a quick-moving media cycle often skipping to the next story, a number of underperforming Web3 companies have been flying under the radar.

But that doesn’t paint a complete picture. Last year saw several companies technically classified as ‘Web3’ double down — or pivot into — more lucrative sub-sectors.

Medallion, for example, announced a $13.7 million Series A (and ambitious plans to bolster its presence in the increasingly crowded superfan arena) in December of 2023. And ahead of its 2022 relaunch, the revamped LimeWire was billed as a “one-stop marketplace for artists and fans alike to create, buy and trade NFT collectibles with ease.”

Then, the platform scored a $6.5 million raise in May of 2023 before shifting into the burgeoning generative AI sphere, a move set in motion by the September buyout of BlueWillow. Other Web3-focused music companies are likewise reinventing themselves to align with market trends.

Meanwhile, multiple Web3 plays have drawn huge funding rounds in January of this year. So what’s likely to happen in 2024? That’s the focus of our latest DMN Pro Weekly Report.

Report Table of Contents

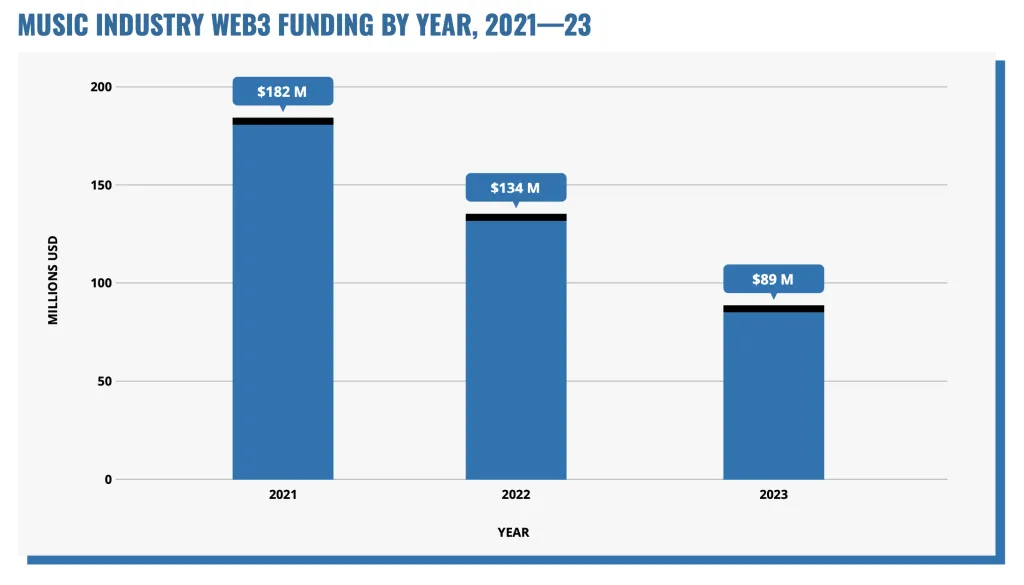

I. A Look At Web3 Music Startups’ Funding

Graph: Web3 Music Funding by Year, 2021-23

II. How Web3 Companies Evolved During 2023

III. Not All Digital Technologies Are Made Equal – NFTs Face Pronounced Market Challenges

Graph: Music NFT Funding by Year, 2021-23